While economists and journalists talk a lot about the strength of the economy in 2025, the day-to-day reality for Americans seems to suggest a different story.

Our original research digs into the self-reported financial situation of everyday Americans.

Paycheck-to-paycheck lifestyles, struggles to cover emergency expenses, reliance on unsecured debt to cover necessities, and feeling compelled to cut back on eating out and other “extra” expenses all emerge as recurring themes.

We’ll explore how these issues impact people across generations, regions, incomes, employment status, and more.

Table of Contents

Methods

The survey, conducted on January 13, 2025 via a third-party survey platform, sampled 1,000 respondents online through desktop and mobile devices to gather data on the average American’s financial situation, financial goals, and debt management strategies in 2025.

The survey used Random Device Engagement (RDE), which recruited participants during their regular online activities across various websites and apps. This method minimized selection bias and improved the reliability of the data. Stratified random sampling divided participants into subgroups based on factors like age, income, and employment status. Within each stratum, respondents were selected randomly, ensuring diversity and reducing sampling error.

The survey included single-selection, slider-scale, and open-ended questions to gather categorical, continuous, and qualitative data. Descriptive statistics, stratification adjustments, and response weighting were applied to analyze the results.

A margin of error of ±3.1% at a 95% confidence level was calculated using the formula: MOE = z × √[ p(1 – p) / n ] where:

- = 1.96 (z-value for a 95% confidence interval)

- = 0.5 (maximum variability)

- = 1,000 (sample size)

Key results

- 53% of respondents are living paycheck to paycheck.

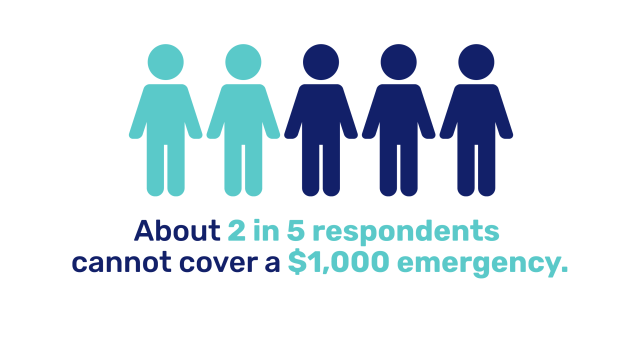

- 40.1% of respondents are unable to cover a sudden $1,000 emergency in cash.

- Among those who cannot cover a $1,000 emergency, 34% would turn to credit cards.

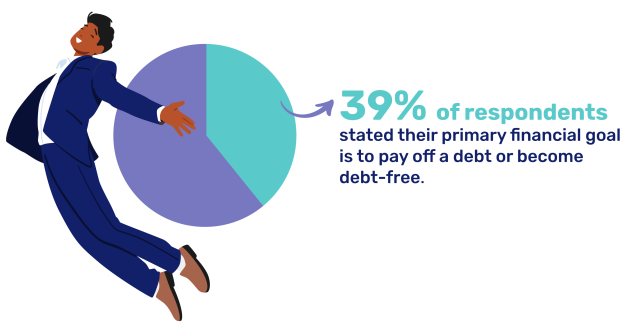

- 39% of respondents stated their primary financial goal is to pay off a debt or become debt-free.

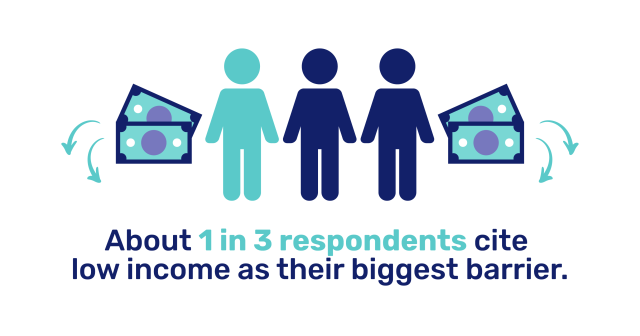

- 32.5% said the main obstacle to achieving their goal is that their income is too low.

- Just over 1 in 4 respondents say high living costs are their primary challenge.

Discussion

Americans are prioritizing paying off their debts, and becoming debt-free

Debt is a major obstacle preventing Americans from reaching financial stability. According to our survey, 39% of respondents said their primary financial goal is to pay off debt or become completely debt-free. This goal outweighs saving, homeownership, and investment priorities, illustrating how financial obligations shape the long-term outlook of many Americans.

The weight of debt varies by generation and income level. Among paycheck-to-paycheck respondents, 13.8% cited “I have too much debt” as their biggest financial challenge, while 32.5% said their income is simply too low to make meaningful progress on getting out of debt and building savings. These challenges are even more pronounced for lower-income households.

A common refrain was Dave Ramsey and the debt snowball approach to payoff that Ramsey has popularized.

“I plan on using the steps from Dave Ramsey’s Financial Solutions. I plan on using the snowball method to pay off debt.”

Female, Age 33, living paycheck to paycheck in the Northeast.

“My financial plan for 2025 is to use the snowball method to continuously pay off debt. In an effort to remain positive, I’m not thinking about challenges at this time.”

Female, age 53, living paycheck-to-paycheck in the South.

Living paycheck to paycheck is a widespread struggle

53% of our respondents report living paycheck to paycheck, which has wide-ranging effects on lifestyle and financial wellness.

While there’s a direct correlation between income range and paycheck-to-paycheck living, the issue exists across the whole spectrum of household income ranges.

| Income Range | % Living Paycheck to Paycheck |

| Under $50,000 | 72.8% |

| $50,000 – $99,999 | 44.0% |

| $100,000 – $149,999 | 32.3% |

| $150,000 and above | 20.6% |

Who’s living paycheck to paycheck? Gen Z and Milennials more than most

The paycheck-to-paycheck crisis is more pronounced among younger generations:

- Gen Z (68.5%) are the most likely to live paycheck to paycheck.

- Gen X and Millennials are close behind, with 54.5% of Gen X and 56.5% of Millennials living paycheck-to-paycheck.

- Baby Boomers (41.5%) and the Silent Generation (40%) fare slightly better but still commonly cited their primary financial challenges being rising costs and fixed incomes.

Where are Americans living paycheck-to-paycheck?

Where Americans live also plays a significant role in their financial situation.

- The South has the highest proportion of paycheck-to-paycheck residents at 57%.

- The Northeast follows at 54.6% living paycheck to paycheck.

- While the Midwest (48.9%) and West (49%) report slightly lower rates.

The cost of living and employment opportunities in each region contribute to these disparities, with high housing costs in the Northeast and West creating additional financial pressures.

Emergency savings: Can you cover an unexpected $1,000 expense in cash?

A sudden $1,000 expense—such as a medical bill or car repair—can be a challenging curveball for many households. Our research found that 40.1% of respondents said they would not be able to cover a $1,000 emergency with cash.

Turning to credit cards to cover emergency expenses

Among those who cannot cover a $1,000 emergency:

- 34% turn to credit cards.

- 13% borrow money from family or friends.

- 9.8% say they simply “don’t know” what they would do.

- 5.1% avoid the payment altogether.

Lower income households most vulnerable to a financial crisis, yet higher earners still struggle

Lower-income households are at the highest risk, with 72.9% of those earning under $20,000 unable to cover a $1,000 emergency.

Among those earning $100,000 – $124,999, 24.4% still cannot cover a $1,000 emergency in cash.

Gen Z and Milennials have the least emergency savings

The ability to handle emergencies also varies by generation:

- 47.9% of Gen Z and 44.8% of Millennials cannot cover a $1,000 emergency.

- 42.3% of Gen X and 27.8% of Baby Boomers also cannot cover a $1,000 emergency.

Takeaways

Employment isn’t the biggest problem

Among paycheck-to-paycheck respondents:

- 75.3% are currently employed or self-employed.

- 18.2% rely on Social Security, pensions, or other passive income sources.

- 6.5% are currently unemployed but expect to start earning within six months.

This is on par with the general population surveyed, and indicates that the paycheck-to-paycheck dilemma is not exclusive to being unemployed or underemployed.

Income and cost of living most often blamed

For those living paycheck to paycheck, several key financial barriers emerge:

- 32.5% cite “my income is too low” as the biggest roadblock.

- 27.7% blame the rising cost of living.

- 16% report having zero discretionary income after bills and basic needs are paid for.

“My plan is to pay off my truck. I will eat out less. I see the cost of living putting a hold on me.”

Male, Age 36, living paycheck-to-paycheck in the Midwest.

Opportunity to grow awareness around budgeting and debt management strategies

With 39% of Americans prioritizing debt repayment, financial education is essential. Respondents shared strategies such as:

- Using the snowball method to pay off smaller debts first.

- Negotiating lower interest rates on credit cards.

- Avoiding unnecessary spending to focus on long-term financial goals.

That said, there was a lot more discussion of specific terms and strategies for debt management (e.g. debt snowball and debt avalanche) than for budgeting.

This seems to indicate an opportunity for people to become more aware of specific budgeting strategies that can help them achieve their financial goals over time.

![How to Avoid Overdraft Fees [8 Ways] How to Avoid Overdraft Fees [8 Ways]](https://i1.wp.com/qualifylearner.com/wp-content/uploads/2025/05/How-to-Avoid-Overdraft-Fees-8-Ways-150x150.jpg)