It’s a strange time in America for personal finance. Despite record levels of stubborn inflation, fewer people said they struggled to make ends meet in the first quarter of 2023 compared to previous reports. But this improvement conflicts with the increasing number of Americans who said things aren’t getting better for them financially. One possible explanation for this disagreement: Americans might just be surviving—not thriving.

The first edition of The State of Personal Finance for 2023 unpacks this development in the data and investigates possible factors that may be contributing to it.

Executive Summary

Download a PDF version of the report.

Fewer Americans Are in Financial Crisis Mode

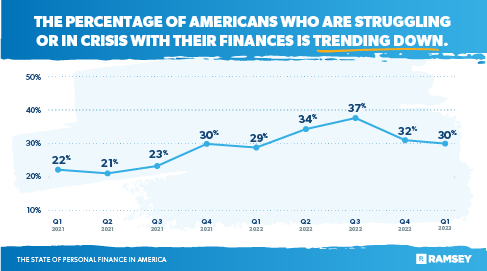

According to data from the first quarter of 2023, the number of Americans struggling to make ends meet peaked at 37% back in Q3 of last year and has steadily declined since then.

1 in 3 Americans Reported They’re Struggling or in Crisis

When asked about the overall state of their personal finances, about a third of Americans (30%) said they’re either struggling or in crisis. That’s a decline of nearly 19% from the high in Q3 of 2022 (37%).

Breaking this data down further, more women than men feel insecure about their financial status (38% vs. 21%), and millennials are the most likely to struggle (37%). Baby boomers, who generally earn more income and have more assets than the younger generations, are the most stable with only 22% saying they’re struggling or in crisis.

Difficulties Providing Food and Paying Bills Dramatically Drop

One of the biggest indicators of financial struggle is the ability to provide the basic necessities—what we call the Four Walls (food, utilities, shelter and transportation). Inflation has been eating away at Americans’ buying power over the last two years, but the number of people who said they had difficulty providing food and paying their bills over the past three months dropped for the third-straight quarter.

Almost 60% of Americans said they don’t have trouble paying their bills, and almost 70% said they don’t have difficulty providing food. Both stats have gone up almost 10 percentage points since Q2 of 2022. Gen Z struggles the most, with 65% saying they’re having trouble paying bills and almost half (47%) finding it hard to pay for food.

Trouble Making Rent Drops to Pre-2021 Levels

The number of Americans having trouble affording housing experienced a similar drop over the last three quarters. Though half of renters are having difficulty making their monthly rent payment (which is a significant amount), that’s a drop of nearly 22% from the high of Q3 2022.

Homeowners are having an easier time paying their mortgages, with only 38% reporting issues. That’s a 22% decline from the high in Q2 of 2022 and a two-year low.

Americans Don’t Feel Like They’re Winning Financially

The numbers may show more Americans are financially stable based on their ability to afford the basics, but by and large, they don’t feel like things are getting better. Plus, younger generations are following in the footsteps of their parents and saddling themselves with credit card debt at a time when interested rates are the highest they’ve been in decades.

Only 36% of Americans Said They’re Winning With Money

As motivational speaker Zig Ziglar once said, “Your attitude, not your aptitude, determines your altitude.” But most Americans don’t have a great attitude about their financial altitude. Only 36% said they’re winning with money. Not surprisingly, a similar number of Americans (33%) said they believe they can become millionaires.

Men were more likely to say they’re winning with money than women (43% vs. 29%). And that gap is even wider when it comes to those who believe they can become a millionaire (43% of men vs. 25% of women).

Fewer Americans Are Taking Summer Vacations in 2023

One of the sacrifices Americans may be making so they can afford to pay for housing and bills is skipping vacation. The summer travel season is coming up, but just over half of Americans (53%) said they’re planning to take a vacation this summer. That’s down nearly 9% from the same time last year. And of those Americans who are taking vacations, one-quarter plan to spend less than normal.

Households with higher incomes were more likely to say they’ll take a vacation this year. Only 37% of those who make less than $50,000 a year said they’re planning on a vacation, while Americans making $50,000 to $100,000 were 54% more likely to be planning a vacation. And almost three-quarters of those making over $100,000 a year (74%) are taking summer vacations.

Is Tipping Out of Control in America?

Tipping has gotten a lot of attention recently, especially on social media. While it’s always good to be generous with people who provide exceptional service, a majority of Americans said there’s an increasing expectation for customers to tip. With attitudes about money at low levels, Americans are paying more attention to their spending, which may be why 67% of Americans believe tipping is out of control.

Americans overwhelmingly agreed tipping requests are on the rise (82%). And 63% said they feel pressured to tip where a tip was usually unnecessary, while 66% said they feel guilty when they don’t tip. Surprisingly, Americans are almost even about whether people should tip—regardless of service (53% shouldn’t vs. 47% should).

Younger Generations Are Falling Into Credit Card Debt

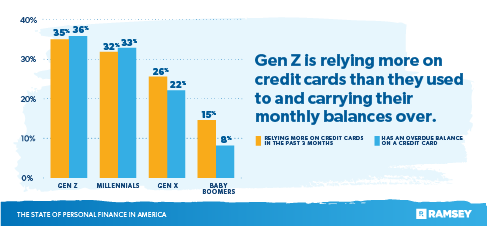

Only 23% of Gen Z said they use credit cards for everyday purchases like groceries and regular bills. Older generations are more likely to use credit cards—with over half (56%) of baby boomers saying they use credit cards on a regular basis.

However, Gen Z was more likely than baby boomers (35% vs. 15%) to say that they’ve relied more on credit cards in the last three months than they used to. They’re also more likely to have an overdue balance (36%) than baby boomers (8%).

So, while Gen Z isn’t as likely to use credit cards for daily expenses, they are running up balances they can’t pay off at the end of the month. Whether that’s for emergency spending or to prop up their lifestyle, the result is the same: They’ll have to deal with the added expense of today’s steep interest rates as they pay off that debt.

Hope in the Midst of Financial Uncertainty

Americans’ perceptions about their personal finances are continuing to get worse, but there are promising signs of improvement—signs that counter the toxic money culture on two fronts.

A Majority of Married Couples Combine Their Finances

A good marriage is a partnership built on love and trust—and that includes trust about finances. Our advice has always been for married couples to combine their finances because it leads to better communication about more than just money.

The data show that a sizeable majority of married couples (64%) agreed with that approach and have completely combined their finances in shared bank accounts. Baby boomers are the most likely to combine their finances (70%), while just 54% of Gen Z said they do the same. Only time will tell whether the gap widens or shrinks.

A Debt-Free Lifestyle Is Still the Best Protection Against Financial Storms

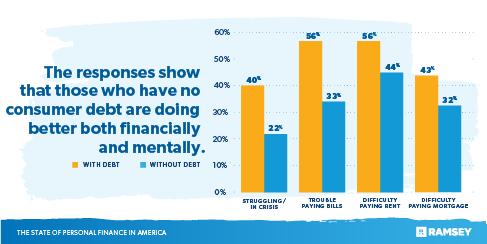

While the data show that most Americans feel stressed about their finances, there’s a recurring theme in many of the key datapoints we’ve covered in this study: Americans who have no consumer debt fare better than those who have debt—both financially and mentally.

Overall, 40% of those with debt said they’re either struggling or in crisis with their money compared to 22% of those with no debt. When it comes to paying bills, 56% of those with debt said they’re having trouble while only 33% of those who are debt-free said the same—a 52% difference. The pattern continues with issues like difficulty affording rent (56% with debt vs. 44% without) and a mortgage (43% with debt vs. 32% without).

People who are debt-free also have a more positive personal outlook. Just 31% of those who have debt feel like they’re winning with money compared to 40% of those without debt.

The average gap between the with/without debt categories is about 10 percentage points, with people who are debt-free reporting more positive outcomes. That’s further proof that becoming and staying debt-free is the best way to create wealth and build a financial cushion that can weather any storm—even out-of-control inflation.

Conclusion

The current state of personal finance in America shows a wide perspective gap between the numbers and people’s actual outlooks. A possible explanation is that Americans have learned to deal with the current challenging financial situation by making the necessary sacrifices to stay afloat. But that doesn’t mean they like making those sacrifices or that those sacrifices are helping them get ahead. This feeling is apparent not just in general attitudes about money but also in how Americans are actually spending their money.

However, the numbers also show that people can take action to relieve their anxiety about money. Being on the same financial page with their spouse and working to become debt-free are two ways Americans can lay the foundation for a more financially stable life. It just takes some intentionality and focus to get there—and millions of people have done it already.

About the Study

The State of Personal Finance is a quarterly research study conducted by Ramsey Solutions with 1,001 U.S. adults to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded from May 8 to 12, 2023, using a third-party research panel.

![How to Avoid Overdraft Fees [8 Ways] How to Avoid Overdraft Fees [8 Ways]](https://i0.wp.com/qualifylearner.com/wp-content/uploads/2025/05/How-to-Avoid-Overdraft-Fees-8-Ways-150x150.jpg)