If you’re thinking about buying or selling a house right now, you’re not alone. The housing market has seen a lot of unusual trends in the past couple years, so it makes sense that you’d want the latest update on what’ll happen in the market before you decide to buy or sell. The truth is, housing market predictions are about as reliable as weather forecasts. The real estate pros make their best forecasts based on data, but no one can know what’s going to happen with 100% accuracy.

Still, even if you don’t know for sure, you can check out what the experts are saying and make some pretty good guesses. Just remember, a housing market forecast can only give you an idea of what to expect if you buy or sell a house in the coming months. You never want to let a market prediction control your housing decisions . . . only your personal situation and finances should do that!

With that said, here’s my real estate market forecast.

Real Estate Housing Market 2023

Okay, first things first: 2023 is not 2021. The crazy way houses were getting multiple offers and selling for thousands of dollars over asking price within hours of going on the market is pretty much over. But the U.S. real estate market is still strong. It’s just not crazy anymore. And really, crazy just adds an extra level of stress to buying or selling a house.

So, three cheers for no more craziness!

When Will the Housing Market Crash?

Based on the data, it’s unlikely the housing market will crash in the next few years because the current market is so different from the housing market crisis that caused the Great Recession of 2007–09.

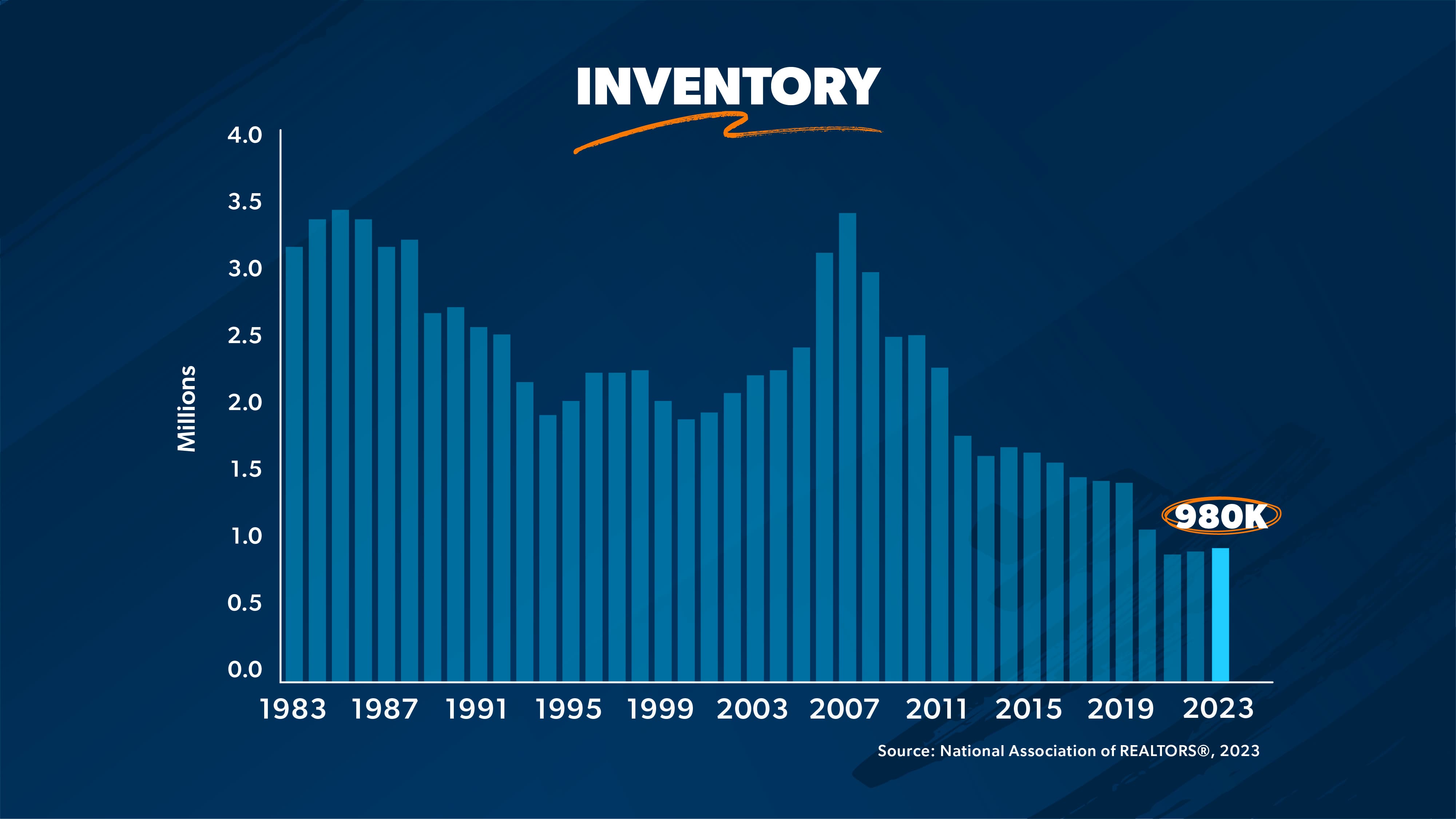

Lending rules are stricter now, so experts don’t expect a massive amount of foreclosures (I’ll cover more on that later). Plus, housing supply is still super low and probably won’t catch up for a few years. So there’s little to no danger of home prices dropping like a rock—even if they trend down a bit in some markets.

What’s the Average House Price in 2023?

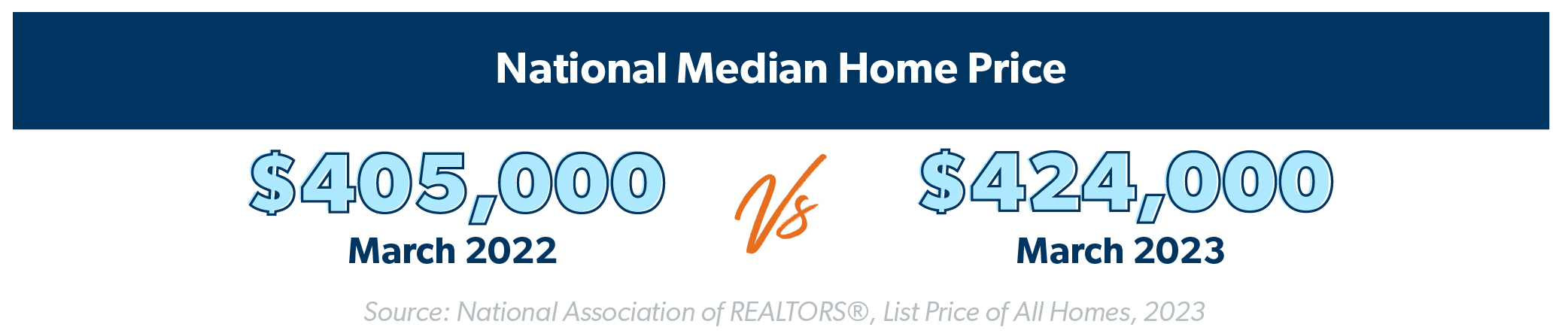

The average home price in the U.S. was $761,540 in March 2023 (including existing homes, new builds, single-family homes, condos and townhomes).1 But most experts report on the median, which saw an annual increase of 6.3% to $424,495.2

Remember, median means half of all homes were listed for more than that and half were listed for less. It’s usually better to look at median home price than the average. That’s because a small group of abnormally high- or low-priced houses can throw off the average and make regular homes seem more or less expensive than they really are. (Just something to keep in mind as you watch the average house price in 2023 fluctuate.)

The main thing to know about this (and any) market is that home prices are determined by supply and demand. And since there’s still strong buyer demand and a shortage of homes for sale, prices aren’t going to plummet. And they aren’t going to spike either. Home prices may go up and down a little in certain markets—but they’re unlikely to change drastically enough to completely alter your housing plans.

Housing Market Recession: What Is It and Are We in One?

A housing market recession means the total number of home sales has been shrinking for at least six months in a row. So are we in some kind of housing recession? Well, we sort of were—until the number of home sales shot up 14.5% in February 2023, which marked the end of 12 straight months of decreases.3 And while Fannie Mae predicts overall home sales in 2023 to drop 18.4%, a housing recession isn’t really something to worry about—since home prices aren’t in a recession.4

Find expert agents to help you buy your home.

You see, 2021 was a record year for sales—so what we’re really seeing now is home sales volume returning to normal, pre-pandemic levels. In other words, this is more of a housing market correction than a recession. After dropping in 2023, Fannie Mae predicts home sales to rebound by 7.1% in 2024.5

The market would only be something to worry about if the declining home sales were an indicator of too much supply (houses for sale) and not enough buyer demand—which could cause home values to plummet and hurt the overall economy. But that’s not the case here.

Are We in a Housing Bubble?

You might hear people freaking out asking if the housing market is in a bubble. The term housing bubble describes a period of skyrocketing home values. Prices go up and up until—pop! The bubble bursts and home values plunge. That would be scary. But it doesn’t look like that’s happening.

It’s true that home values experienced rapid growth following the impact of COVID-19—but that spike started softening in the middle of 2022. Home values began hitting double-digit annual growth in mid-2020 and mostly kept up that trend until 2022. And now we’re back down to single-digit annual growth—along with slight declines in some markets. But there are still no signs of prices crashing.

Will It Be Cheaper to Buy a House in 2023?

There are mixed feelings about what home prices will do in 2023. Houses probably won’t be much cheaper than they’ve been in the past few years—but they’re at least unlikely to shock anyone with rapid increases or decreases.

Experts at the National Association of REALTORS® (NAR) actually predict home prices to go up by 0.3% compared to 2022.6 Meanwhile, Freddie Mac and the National Association of Home Builders (NAHB) expect home prices to drop by 0.2%—or as much as 15%.7,8 But again, there are no signs of rapid decreases. And minor price fluctuations shouldn’t really influence your plans one way or another.

Will Home Prices Drop in 2023?

Remember, the only factors that could cause home prices to fall rapidly are related to supply and demand. If the number of homes for sale started booming, then buyers wouldn’t have to compete as hard as before for such a small selection of homes. But since we’ve had a supply shortage for a long time now, more homes for sale would probably just help to even out the market.

On the other hand, there are ways buyer demand could sink. For example, the Federal Reserve could continue to increase federal interest rates like they did in 2022. While the Fed doesn’t directly set mortgage rates, federal rate hikes usually cause mortgage lenders to raise their rates too. Some buyers may back out of the market to avoid those higher rates. But again, the pandemic had so many buyers putting off their plans to buy a home. And that means buyer demand is still greater than housing supply. So home prices are likely to stay mostly the same in 2023—with some markets experiencing a small increase or a small decrease in dollar amount.

Now, if you’re thinking of selling, don’t stress. The average house price in 2023 is still higher than in past years, so odds are you’ll still make a pretty penny. But if you’re waiting to sell because you think your home will double in value soon, don’t count on it. You’ll want to decide whether to sell your house based on the reality of your situation—not what you hope the market will do.

On the flip side, if you’re looking to buy, the cooling price-growth rate is good for you . . . but the higher interest rates, not so much. You’ll want to make sure you’re truly ready to buy a home before you dive into the market this year. (Or any year, actually. It’s always good to be prepared!)

Like I mentioned earlier, it’s hard to predict how home prices will change over time. So, whatever you do, keep saving for a big down payment if you want to buy a home with confidence. (I want your home to be a blessing, not a curse.)

Housing Market Forecast 2023

A lot of people are trying to forecast how the housing market will turn out in 2023. Some news headlines make it sound like the housing market downturn will be worse in the coming years. But as I mentioned earlier, the market is looking like it’ll stay pretty steady in 2023.

Remember, the news often hypes things up just to get your attention. Ignore the headlines and look at the data. For example, you might see a news headline that says housing market conditions will worsen in 2023. But then you find out what they really mean is home prices will slightly decrease or grow at a slower rate. The word worsen makes it sound scary (and clickable). But the truth is, steadier prices aren’t a sign of crashing.

Interest Rates

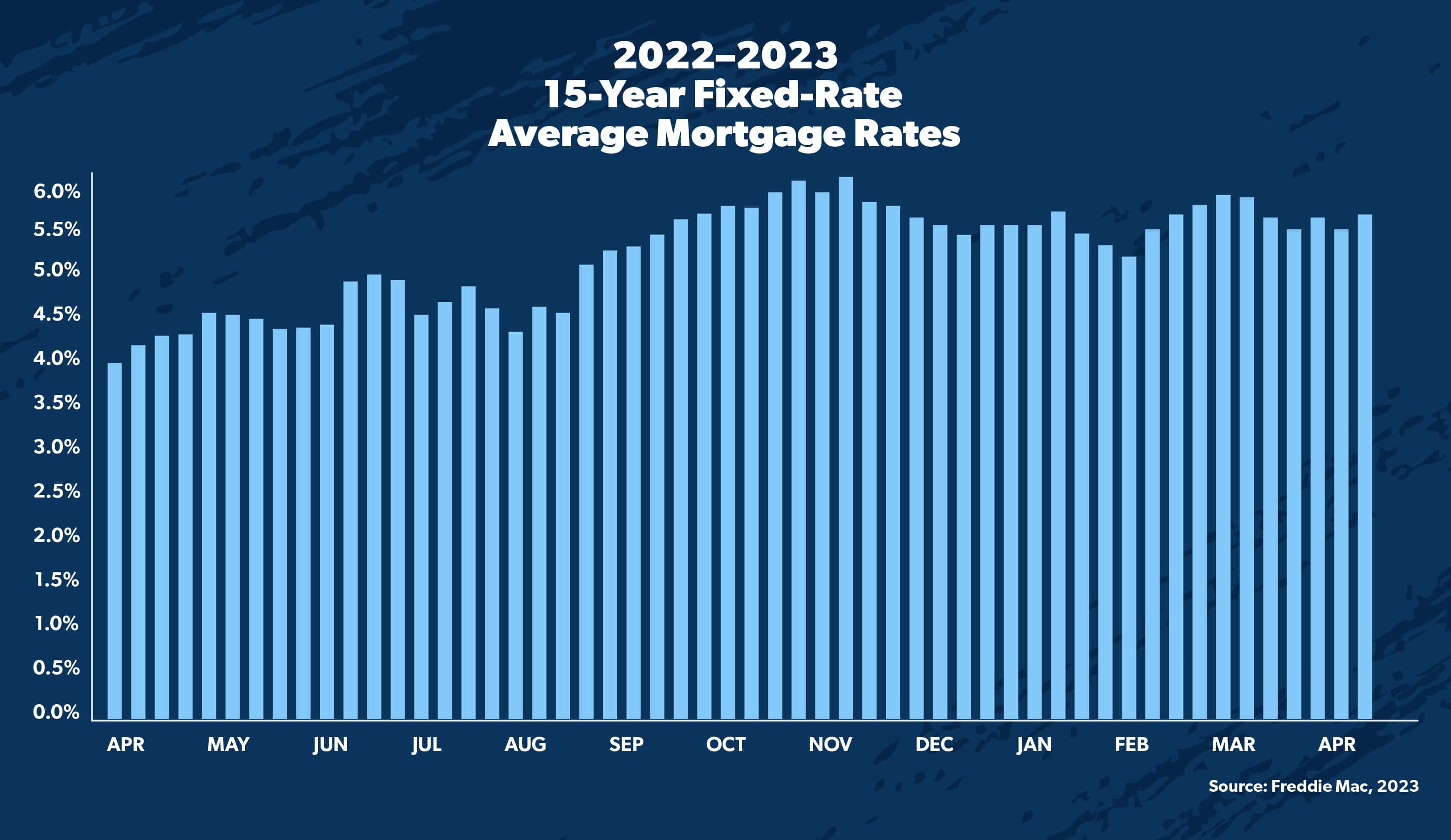

Let’s not forget how interest rates affect the overall cost of your home! In 2022, average interest rates jumped several months in a row from 2021’s all-time low average (2–3%) to more than 6–7% in November! On the bright side, as of April 2023, interest rates went back down to where they were in September (5–6%).9 And Freddie Mac forecasts rates to stay pretty steady in that range for the rest of 2023.10

Interest rates fluctuate daily, but overall, they’re a lot higher than they were in 2021. This stinks because it means new buyers entering the market will end up paying thousands more dollars in interest on their house over time. Higher interest rates also drop your purchasing power—meaning some houses will be priced completely out of your budget. But some of you buyers who held off your plans because of 2022’s rising rates will likely return to the market in 2023—now that rates have dropped a little. And this could increase demand a bit.

Housing Inventory

When it comes to housing inventory in 2023, it looks like the number of houses on the market will still be low. While existing inventory (not including brand-new home builds) saw a slight 5.4% uptick in March 2023 compared to the previous year—it was only a 1% bump month-over-month.11 Overall, the NAHB predicts the number of brand-new home builds to fall more than 25% in 2023—followed by a rebound of 24% in 2024.12

To really cool down the market, there’d need to be twice as many homes for sale.

Will Housing Demand From Buyers Remain Strong?

Buyer demand will stay pretty strong for the rest of 2023. Even though higher interest rates and house prices have lowered demand, homes are still moving quickly. This is a great sign for sellers.

Is It a Seller’s Market Right Now?

A seller’s market is when demand for homes is higher than the supply of homes. And that’s still the case right now. If you’re planning to sell your house, you can expect to sell it fairly quickly for close to asking price—as long as your asking price is realistic for the current market. (It’s easy to value your home based on memories and how much you loved living there, but a good agent will help you price it fairly.)

When Will It Be a Buyer’s Market?

In a buyer’s market, there are more homes for sale than buyers. And since home supply is still low, it doesn’t look like there’ll be a buyer’s market anytime soon.

The good news is, the market isn’t as hot as it was in the past few years. If you’re looking to buy, you’ll have a few more options—and maybe less competition. It might still take longer to save a down payment or find your dream home, but the frenzy is slowing down.

Why Are Houses Selling So Fast?

Homes are still selling fast because there are more buyers than homes for sale.

Even though most homes stayed on the market for 18 days longer in March 2023 compared to March 2022, that’s still a shorter amount of time than before the pandemic.13 So there’s a good chance homes will continue getting snatched up pretty fast for the rest of the year.

This is great news for sellers who are itching to sell quickly. But buyers, stay focused—you don’t want to drag your feet when you find a home that fits your budget and your family. It’s likely other buyers are interested, and it could sell if you wait too long to commit. That’s why you’ve got to know exactly what to look for in a home and what you can afford before you jump in the game. Every market will be a little different depending on where you live, but it’s best to be prepared.

Will There Be a Lot of Foreclosures in 2023?

March marked 23 straight months of year-over-year increases in foreclosure activity.14 And it’s likely that trend will continue throughout 2023. Keep in mind, a number of these foreclosures weren’t new. Many were just delayed because of a government moratorium on foreclosures during the pandemic. So, while some were worried about a huge wave of foreclosures flooding the market after the ban was lifted, that hasn’t been the case.

Get this: While foreclosure repossessions were up 67% in 2022 compared to 2021—that was still down 70% compared to 2019, and down 96% compared to the peak of foreclosures in 2010 caused by the Great Recession.15 The good news is, most of the homes in foreclosure today probably won’t be repossessed by lenders like they were during the Great Recession. That’s because many of the borrowers in foreclosure today have positive equity (their homes are worth more than they owe), which they can use to avoid foreclosure by selling their house or refinancing their mortgage.16

Here’s what all this foreclosure stuff means for homeowners and buyers:

- Homeowners: Since the market isn’t going to get flooded with foreclosures, you can rest easy knowing your home isn’t going to tank in value because of a sudden increase in home inventory.

- Home buyers: If you’re waiting to find a great deal on a foreclosure, don’t hold your breath. This market is nothing like the Great Recession. And keep in mind, buying a foreclosed home could come with its own set of potential issues. So, make sure you do your homework on the house and know what you’re getting yourself into before you buy.

Current Housing Market Key Takeaways for Buyers and Sellers

It could be a great time to buy a house in 2023—if you’re ready. It could also be a horrible time to buy if you’re not. But you can’t let what’s happening in the housing market decide this for you.

What really matters when buying a house are your personal finances and season of life. You’re ready to buy a house if (and only if) you can check off these boxes:

- You’re debt-free.

- You have an emergency fund of 3–6 months of expenses.

- Your monthly house payment will be 25% or less of your monthly take-home pay on a 15-year fixed-rate mortgage.

- You have a down payment. A 20% down payment is ideal because you’ll avoid paying private mortgage insurance (PMI). But 5–10% is okay, too, if you’re a first-time home buyer. Just be prepared to pay PMI. And steer clear of FHA and VA loans—you’ll pay much more in interest and fees with them.

- You can pay the closing costs up front without stealing from your down payment.

If you don’t meet these qualifications, it doesn’t matter if the market is in your favor. Buying a home would end up being a curse instead of a blessing. Take your time to get in a better financial position so you can buy a house the right way.

Is Now a Good Time to Buy a House?

Here’s the thing. I’ve mentioned the market shouldn’t determine your decision to buy a house. If you’re prepared to buy a home, then it’s a good time, even if inventory is limited. If you’re not prepared, it’s not a good time, even if there’s plenty of inventory.

Because of the number of buyers for existing homes and higher material costs for new homes, options might be slim. If you’re prepared to buy a house, you may have to give up some of your wants to get a house that has everything you need.

Should I Sell My House Now or Wait?

Sellers can feel confident about selling their homes in 2023. If that’s you, you might want to put your house on the market sooner rather than later—while inventory is still low. (But again, only do that if you’re truly ready to sell your house. Don’t let the market be the deciding factor!)

When you decide to sell, keep in mind that there aren’t quite as many buyers in 2023 as there were in 2021 when mortgage rates were at an all-time low, but there are still lots of people wanting a home.

If you work with an experienced agent, you’ll be able to capitalize on home prices, navigate multiple offers, and find the right buyer. With an expert by your side, it’ll be even easier to sell your house at a great price this year.

How to Buy or Sell With Confidence in Any Housing Market

The housing market isn’t known for being easy to predict. That’s why it pays to have a professional in your corner who’s earned the RamseyTrusted shield.

Whether you’re buying or selling, you need an agent who knows how to navigate a changing real estate market. And you can find them through our RamseyTrusted program. The agents we recommend are the top real estate experts in their areas and will help you reach your housing goals—no matter what the market is doing. That’s why they’re called RamseyTrusted.

Find a real estate agent you can trust!

![How to Avoid Overdraft Fees [8 Ways] How to Avoid Overdraft Fees [8 Ways]](https://i1.wp.com/qualifylearner.com/wp-content/uploads/2025/05/How-to-Avoid-Overdraft-Fees-8-Ways-150x150.jpg)