Aah yes, there are still some things in life that are simple and straightforward. Voiding a check is one of them.

Voiding a check basically means you’re canceling it so it can’t be used to make a payment or withdraw money from your account.

Here’s everything you need to know about how to void a check.

How to Void a Check in Three Steps

Learning how to void a check is super simple. Just follow these three steps:

Step 1. Get a black or blue pen.

Step 2: Write “VOID” in large letters across the front of the check, big enough to cover all of the areas where you’d normally write in information. Or you can write “VOID” five separate times—one in each section (date line, payee line, signature line, amount line and amount box).

Step 3: Make a copy of the voided check for your records before you shred or give away the original.

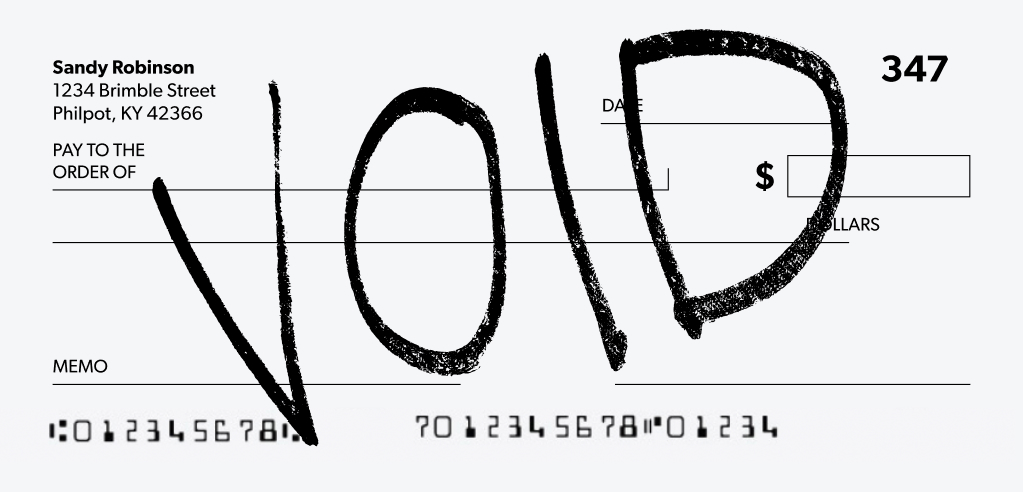

Here’s a voided check example for you.

Yep, it’s really that easy! But unless you’re voiding a filled-out check, make sure you don’t cover up the routing or account number on the check—those are important.

Reasons for Voiding a Check

There are lots of reasons why you may need to void a check, but here are four that happen most often:

- Setting up direct deposit: If you decide to get your paychecks through direct deposit (which can get that money in your account quicker than a regular paycheck method), your employer will probably ask you for a blank, voided check to set up the direct deposit. That’s why it’s important not to cover up the routing and account numbers printed at the bottom of your check. That’s the info your employer needs to get your money in the right account.

- Setting up direct payments: On the flip side of direct deposit, if you’re an employer, you may need to void a blank check to set up electronic payments from your account to pay your employees or vendors.

- Starting regular bill or loan payments: It’s pretty common for a mortgage or loan company to ask you to submit a blank, voided check to set up automatic bill payments.

- Canceling a check you don’t want to be cashed: Those were all example of using a blank, voided check to send or receive money. But what happens if you write a check and don’t want to use it?

Maybe you wrote a check, then realized you didn’t have enough money in your account to cover it. Or maybe you made a silly mistake like spelling a name wrong or adding an extra zero on the check amount. (Those girls selling cookies outside the grocery store don’t need $60 for Thin Mints. Inflation isn’t that high.)

These things happen! No matter the reason for needing to trash a check, it’s a good idea to void it first just to be safe—yes, even if you’re planning to rip it up.

How to Void a Check After Sending It to the Recipient

If you already sent a check that needs to be canceled, it’s obviously a little too late to write VOID across it. But not all hope is lost! There’s still a way to void a check after sending it—but you’ll have to act fast.

Your best bet? Call your bank and ask them to cancel the check through a stop payment order—that blocks the check from being cashed. Some banks actually charge a fee for this. (Ridiculous, but true!)

Budget every dollar, every month. Get started with EveryDollar!

You can also request a stop payment order through your online banking web portal. But read the fine print about when the stop payment will go into effect. Remember, time is really of the essence here, so it may be quicker to void the check over the phone—you know, with a real human being.

Heads up: You’ll need to give your bank specific information about the check, like who it’s going to, when it was dated, and the amount it was for. That’s one of the many reasons it’s always a good idea to keep records of every check you write.

What to Do if You Don’t Have Checks

Need a voided check, but don’t have a checkbook? Hey, that’s okay! There are a few things you can do if you need to submit a voided check but don’t have any. Yes, that sounds literally impossible. Just keep reading.

- Ask your bank teller. Most banks will print you a starter or sample check (also called a counter check) for free.

- Order checks online. Hey, maybe you realize you’d actually benefit from having checks on hand. Just head to your bank’s website and order yourself a checkbook. Or find a safe, legit online company if the bank doesn’t offer the design you want and you don’t mind paying extra to rep your favorite flower, inspirational quotes or sports team.

- Use a deposit slip instead. Whoever’s asking for your voided check usually needs only your routing and bank account number. And guess what? Both of those numbers also show on your deposit slip. Boom.

- Do it online. You might not even need a physical, voided check. If you’re setting up online payments—or direct deposits—see if you can enter your account and routing information online. Just make sure the site is secure. You don’t want some hacker buying 20 Jet Skis with your bank info because you trusted a fishy URL.

There you have it—that’s everything you need to know about how to void a check.

And listen, we’ve got one more pro tip for you here. Whether you’re voiding checks because you’re afraid of overdrafts, you’re juggling debt, or you’re setting up direct deposit at a new job (congrats on that one!)—you’re going to need a budget.

A budget is a plan for your money: everything going out and coming in. That’s how you’ll stop juggling and finally take control of your money.

We’ve got a free budgeting app called EveryDollar you can start using today. No voided check needed!

![How to Avoid Overdraft Fees [8 Ways] How to Avoid Overdraft Fees [8 Ways]](https://i1.wp.com/qualifylearner.com/wp-content/uploads/2025/05/How-to-Avoid-Overdraft-Fees-8-Ways-150x150.jpg)