Budgeting apps have never been more in demand. With inflation squeezing wallets and the beloved Mint app officially shut down, people are scrambling to find the best budgeting apps that work and feel good to use.

Whether you’re trying to split expenses with your partner, track every penny, or stop overspending on takeout, the right app can help you stay organized and hit your money goals faster. The challenge? There are dozens of budgeting apps out there, and most promise the same thing.

That’s why we personally downloaded and tested the best personal budgeting apps of 2025—so you don’t have to. We looked at ease of use, features, pricing, and who each app is best suited for, then narrowed it down to our top 10 picks.

Here’s how they compare.

| App name | Best for | Price |

| YNAB | Best for serious budgeters | $14.99/month or $109/year |

| Empower | Best budgeting app to replace Mint | Free; optional wealth services |

| Goodbudget | Best free envelope budgeting app | Free; $10/month or $80/year for premium |

| Rocket Money | Best budgeting app for beginners | Free; $6 – $12/month for premium |

| PocketGuard | Best budgeting app for college students | $12.99/month or $74.99/year |

| Fudget | Best simple budgeting app for teens | Free; $19.99/year or $14.99/6 months |

| Honeydue | Best budgeting app for couples and families | Free |

| Copilot | Best visual budgeting app for personal finance | $13/month or $95/year |

| Qube | Best digital cash envelope app for couples | Free; $12 – $19/month depending on plan |

| EveryDollar | Best for Dave Ramsey fans | $59.99 (3 mo.), $99.99 (6 mo.), $129.99 (year) |

1. You Need A Budget (YNAB)

Why we picked it

YNAB (You Need A Budget) is one of the most powerful zero-based budgeting tools on the market. It’s designed to help you plan for every dollar ahead of time. So instead of tracking what happened, you’re actively telling your money what to do.

Features we love

- Customizable spending and net worth reports

- Real-time syncing across devices

- Massive free learning library (live workshops, videos, guides)

Our experience

I’ve used YNAB since 2016 to pay off $18,000 in debt, fund a cross-country move, build an emergency fund, and track spending with clarity year over year. It’s not the easiest app to learn in the beginning. But once it clicks, it’ll be the only budgeting tool you’ll ever need.

2. Empower

- App Store: Rated 4.8/5.0 (289K+ reviews)

- Google Play: Rated 4.3/5.0 (24K+ reviews)

- Best for: Replacing Mint

- Plans and pricing: Free to use; Optional wealth management services available

Why we picked it

Empower is the best budgeting app if you’re looking for a Mint replacement because it combines budgeting and investment tracking in one sleek dashboard. You can link all your accounts, monitor spending, and even track your net worth over time—all for free.

Features we love

- Real-time investment performance and retirement projections

- Free portfolio review with a financial advisor

- Budgeting tools plus personalized net worth tracking

Our experience

I downloaded Empower in 2023 to better manage my retirement savings. The investment tracking dashboard is a standout. It shows your asset allocation, performance over time, and how on track you are for retirement based on real numbers.

I also appreciated the free portfolio review, which can give you helpful insights about your progress without any pressure to sign up for wealth management. The budgeting tools are basic but good enough to see where your money’s going each month.

3. Goodbudget

Why we picked it

Goodbudget brings the classic cash envelope method into the digital world—no ATM runs required. It’s great for people who want to plan their spending up front and stay within clear, intentional limits.

Features we love

- Digital envelopes for monthly categories

- Syncs across devices for couples or families

- Works without linking to bank accounts

Our experience

What’s great about Goodbudget is how quickly you can dive in. You’re not required to create an account to start—you just pick your categories (up to 10 with the free plan), choose your budget cycle, and you’re set.

We loved that you can customize when your budget starts and whether it’s weekly, monthly, or semi-monthly. It’s a great way to try envelope budgeting without committing to cash (or even an email address) right away.

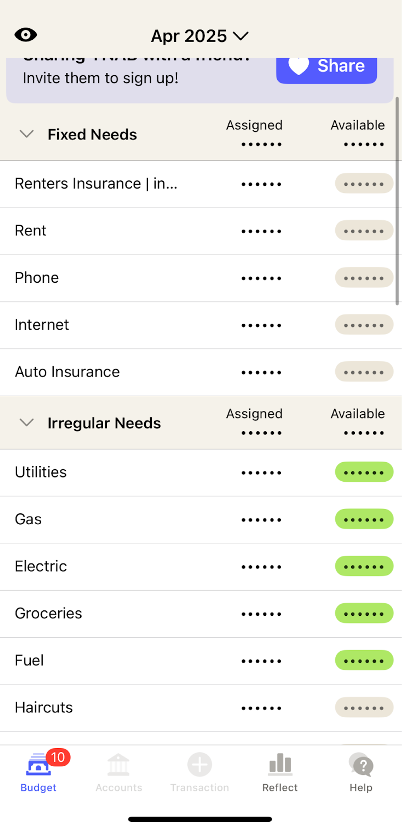

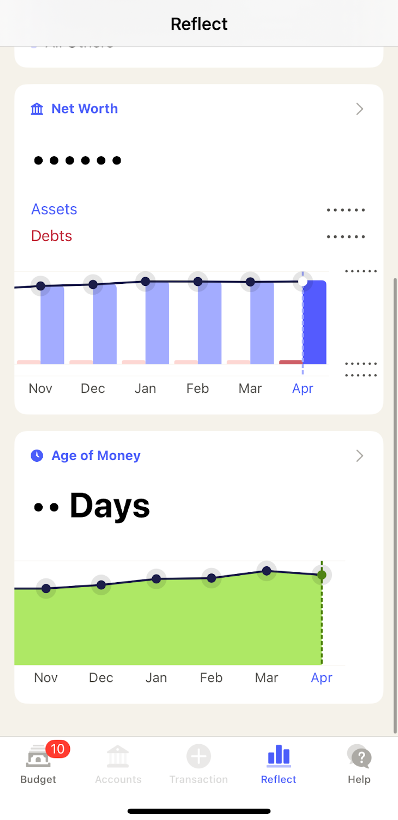

4. Rocket Money

- App Store: Rated 4.4/5.0 (213K+ reviews)

- Google Play: Rated 4.6/5.0 (93K+ reviews)

- Best for: Beginners rebuilding their finances

- Plans and pricing: Free plan, $6 – $12/month for premium, 7-day free trial

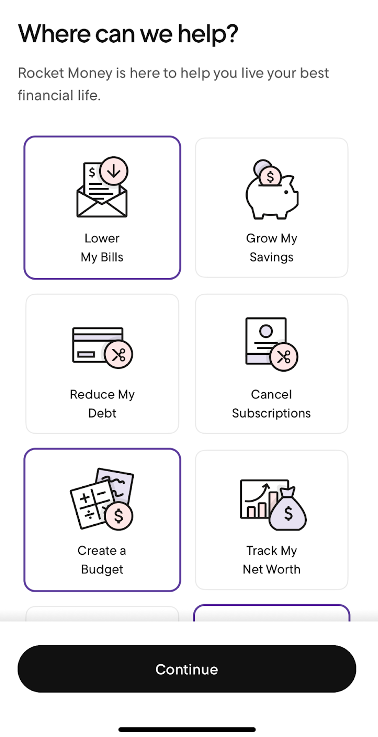

Why we picked it

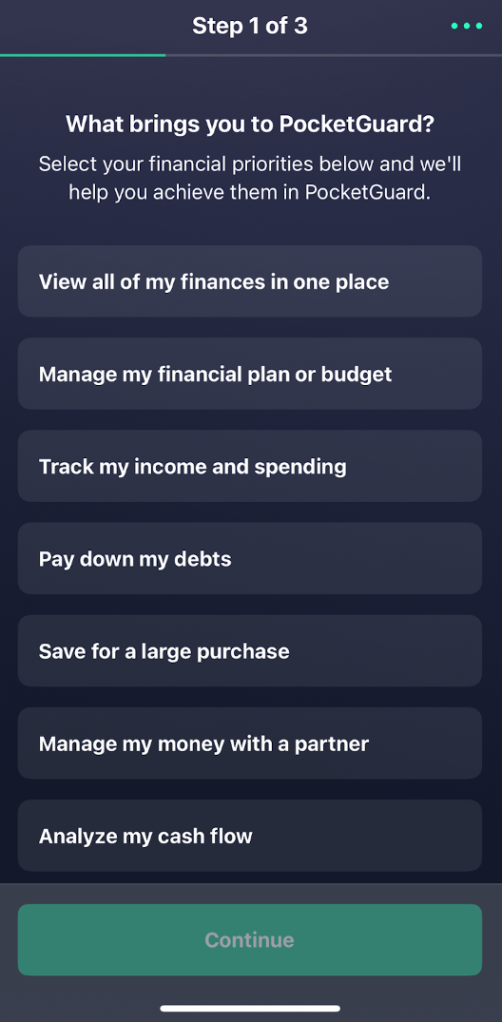

Rocket Money is part budgeting app, part money manager. It helps you spot sneaky subscriptions, lower bills, track spending, and monitor your credit, all in one place.

Features we love

- Tracks and cancels unused subscriptions

- Bill negotiation and credit score monitoring

- Personalized onboarding questions to tailor your goals

Our experience

We loved that Rocket Money starts by asking how you feel about your finances and what you want to work on—whether canceling subscriptions, sticking to a budget, or improving your credit score.

With everything being a subscription, the ability to track and cancel subscriptions automatically is a standout. It’s the kind of app we’d recommend if your expenses feel out of control and you’re trying to rebuild a solid financial foundation.

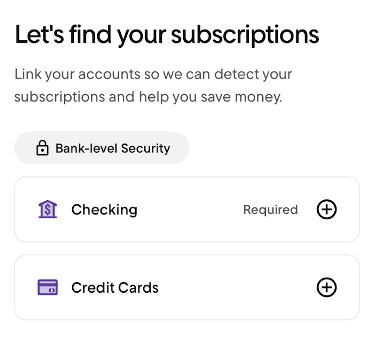

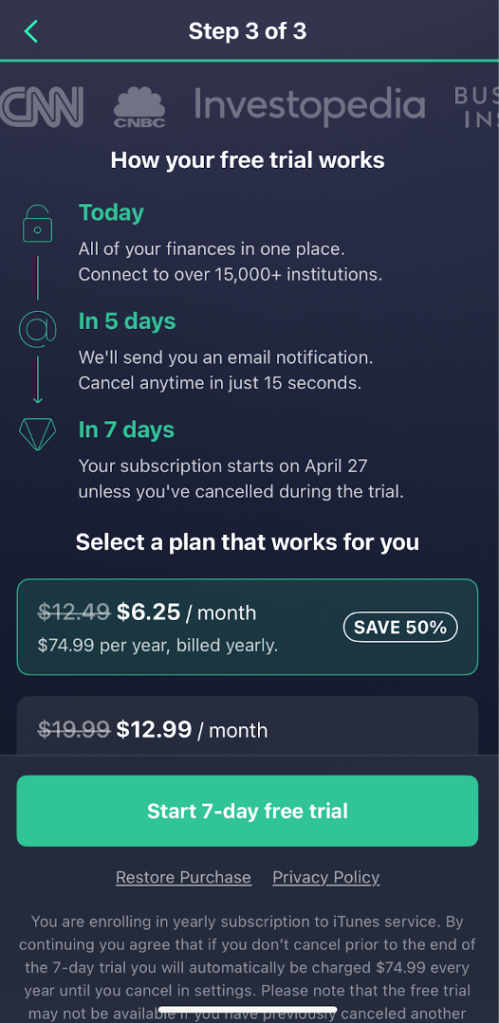

5. Pocket Guard

Why we picked it

PocketGuard takes the guesswork out of budgeting with a clean dashboard and smart features that show you exactly how much you have “in your pocket” after bills and savings. It’s also one of the best budgeting apps for college students who want a low-effort way to stay on track.

Features we love

- “In My Pocket” feature that shows safe-to-spend money after bills

- Subscription tracking and fraud alerts

- Flexible budget cycles and rollover categories

Our experience

We liked that PocketGuard makes it easy to see the full picture of your finances—from cash flow and recurring bills to spending patterns and savings goals. Setup was fast, the categories were intuitive, and we liked that you could split transactions, create custom goals, and even get alerted to subscriptions you forgot about.

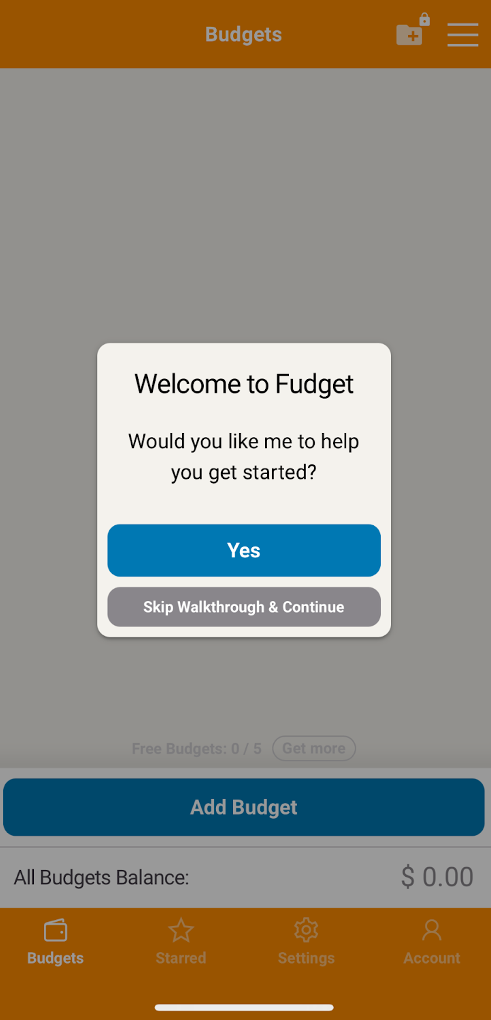

6. Fudget

- App Store: Rated 3.9/5.0 (1,490 reviews)

- Google Play: Rated 4.7/5.0 (769 reviews)

- Best for: Teens and simplicity lovers

- Plans and pricing: Free plan; $19.99/year or $14.99 for a 6-month plan

Why we picked it

If you’re looking for a no-frills budgeting app that doesn’t overcomplicate things, Fudget delivers. There are no graphs, bank connections, or subscription prompts—just a clean way to log income and expenses manually.

Features we love

- Ultra-simple interface with no account linking

- Create unlimited budgets and track recurring expenses

- One-time Pro upgrade (no subscriptions)

Our experience

Fudget is the kind of app you can start using in 60 seconds. We liked that you can create as many budgets as you want—whether it’s for a weekly grocery run or a one-time vacation fund—without getting lost in settings. It’s especially helpful if you’re new to budgeting or just want a low-stress way to stay organized.

*This is the very first screen that comes up when you download the Fudget app—no personal info or signup required.

7. Honeydue

- App Store: Rated 4.5/5.0 (9,300 reviews)

- Google Play: Rated 4.2/5.0 (2,620 reviews)

- Best for: Couples and families

- Plans and pricing: Free

Why we picked it

Honeydue is specifically for couples who want to budget together without merging everything into one account. It’s also one of the best free budgeting apps because there are no tiered plans to pay for. You can share select transactions, chat within the app, and set custom alerts without giving up personal financial privacy.

Features we love

- Shared budgeting with individual account privacy

- In-app messaging and reminders

- Bill tracking and automatic transaction syncing

Our experience

We liked that Honeydue lets couples stay transparent without feeling like they’re handing over control. You can split bills, tag transactions, and even send a quick “what was this charge?” message in the app. It’s ideal for partners trying to get aligned without getting overwhelmed.

8. Copilot

- App Store: Rated 4.7/5.0 (646 reviews)

- Google Play: Not available

- Best for: Visual learners and iOS users

- Plans and pricing: 30-day free trial, then $13/month or $95/year

Why we picked it

Copilot is one of the sleekest, most visual budgeting apps out there. It’s built for Apple users and gives you a beautifully designed dashboard with bubble charts, cash flow timelines, and AI-powered transaction categorization.

Features we love

- Real-time category bubbles that adapt to your spending

- Auto-syncs with accounts and sorts transactions using AI

- Net worth and cash flow tracking in one place

Our experience

Copilot feels like a financial dashboard built by someone who actually gets how our brains work. We loved how easy it was to spot overspending just by glancing at the color-coded category bubbles. Setup was quick, syncing was seamless, and everything looked good enough to screenshot. If you’re someone who needs visual clarity to stay engaged, this one’s a winner.

9. Qube

- App Store: Rated 4.6/5.0 (1,600 reviews)

- Google Play: Rated 4.2/5.0 (415 reviews)

- Best for: Digital envelope budgeting for couples

- Plans and pricing: Free plan, $12/month ($108/year) for Premium, $19/month ($180/year) for Family

Why we picked it

Qube is like a digital envelope system on steroids. You preload money into virtual “qubes” and can only spend from an active one, adding real-time accountability to every swipe. It’s ideal for anyone who wants to recreate the discipline of cash without ditching their debit card.

Features we love

- Real-time spending from designated categories (“qubes”)

- Partner permissions for joint budgeting

- Spending freezes and funding delays to prevent impulse buys

Our experience

Qube felt like a modern twist on the envelope system with added guardrails. We liked that you can’t accidentally overspend. If a qube isn’t open, your transaction won’t go through. It takes some setup and habit-shifting, but it’s incredibly effective if you want to create hard spending limits without carrying cash.

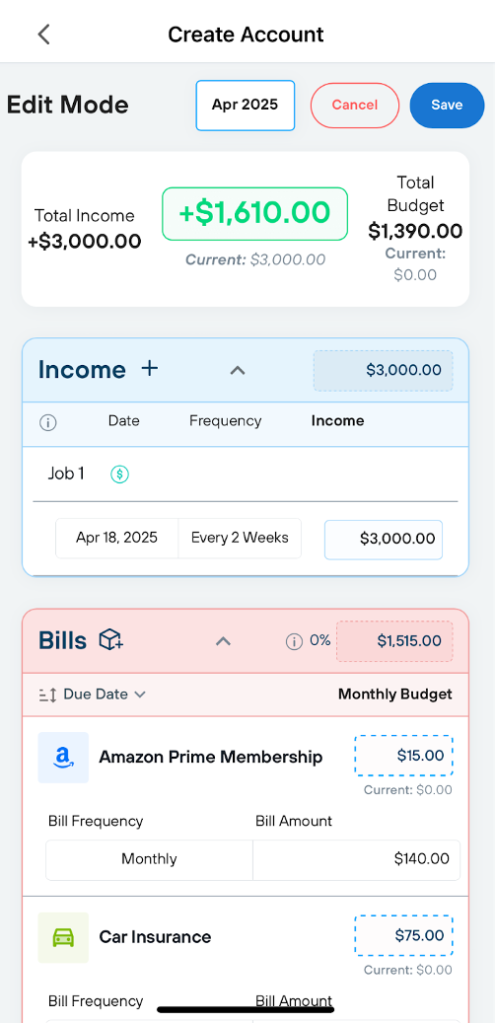

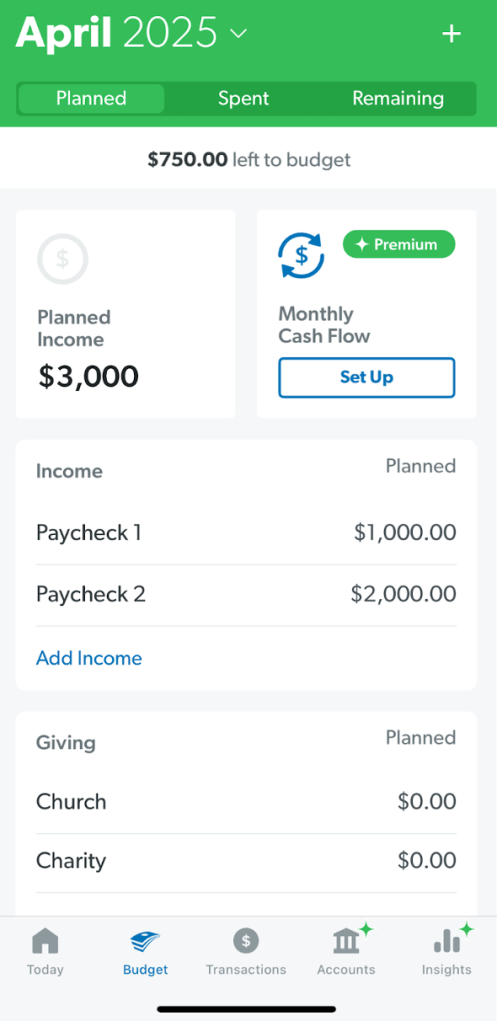

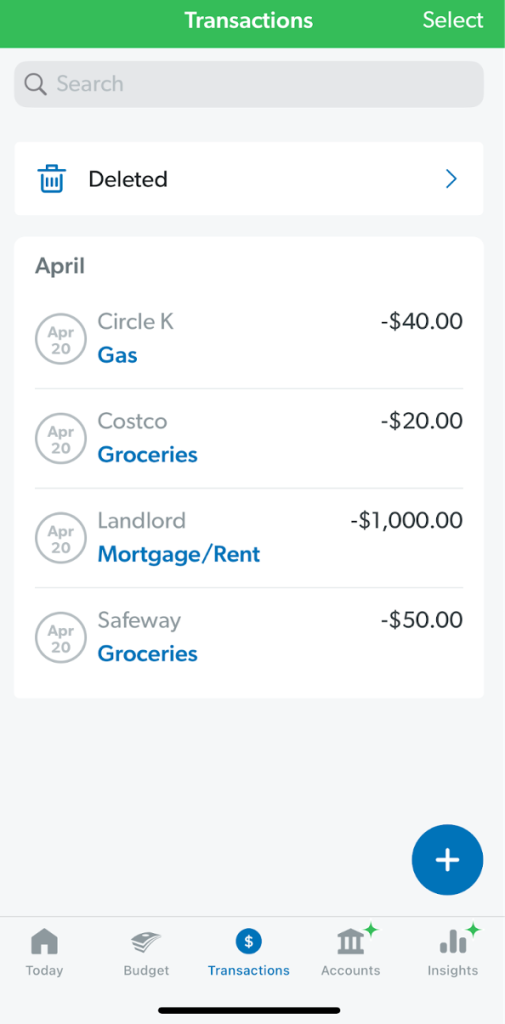

10. EveryDollar

- App Store: Rated 4.4/5.0 (13K+ reviews)

- Google Play: Rated 4.7/5.0 (73K+ reviews)

- Best for: Dave Ramsey fans

- Plans and pricing: Free plan, $59.99 for 3-month plan, $99.99 for 6-month plan, $129.99 for 12-month plan, 14-day free trial

Why we picked it

EveryDollar is built around Dave Ramsey’s zero-based budgeting method and integrates directly with his 7 Baby Steps. It’s ideal if you’re following his debt-free plan and want a simple, goal-driven app to stay on track.

Features we love

- Built-in Baby Steps tracker for debt payoff and saving goals

- Zero-based budgeting system that mirrors Ramsey’s method

- Syncs with bank accounts on the paid plan

Our experience

Back when I was doing Dave Ramsey’s Baby Steps to pay off debt and build my emergency fund, I would have loved having an app like EveryDollar. It makes it easy to stick to a plan, track your progress, and stay focused—especially if you’re already aligned with Ramsey’s approach. It’s similar to YNAB in structure, but with more built-in coaching if you’re following the Baby Steps playbook.

I really like that the Rocket app includes a feature to help lower bills you might be overpaying. I actually recommended it to a client as their budgeting app, and they had nothing but great things to say—plus, they shared real examples of how it helped reduce their bills!

I also recommend Honeydue for couples or families who value transparency around money and want to stay aligned financially. With a big family of my own—including three teenagers—I’m seriously considering using Honeydue for us.

Copilot is also an intriguing option for visual learners like me, thanks to its layout and design. That said, I’m not thrilled that it only works on iOS. One budgeting app I haven’t seen mentioned much is Simplifi by Quicken. I’ve heard mixed feedback—some clients love it, while others really don’t.

My suggestion? Make a list of your top three or four budgeting apps in order of preference. Start with one, and if it doesn’t feel like the right fit, move on to the next. Finding the right tool can make all the difference.

A good budgeting app doesn’t just track your spending—it can completely change how you feel about your money. Whether you’re just getting started or leveling up your finances, the right app can help you stay focused, build momentum, and actually enjoy the process. Test a few, find the one that clicks, and start making real progress toward your goals. You’ve got this!

![How to Avoid Overdraft Fees [8 Ways] How to Avoid Overdraft Fees [8 Ways]](https://i0.wp.com/qualifylearner.com/wp-content/uploads/2025/05/How-to-Avoid-Overdraft-Fees-8-Ways-150x150.jpg)