Much like 2021, 2022 was a year of economic uncertainty for most Americans. Many are less than optimistic about their economic futures, and financial struggles continue to be top of mind—including the difficulty of paying for the basics. Record inflation, skyrocketing gas prices, rising interest rates, job layoffs and rumors of recession weighed heavily on the average American’s economic outlook.

This edition of The State of Personal Finance is a comprehensive look back at our findings for 2022— comparing the personal finance statistic trends over the last 24 months to project what may lie ahead for 2023.

Executive Summary

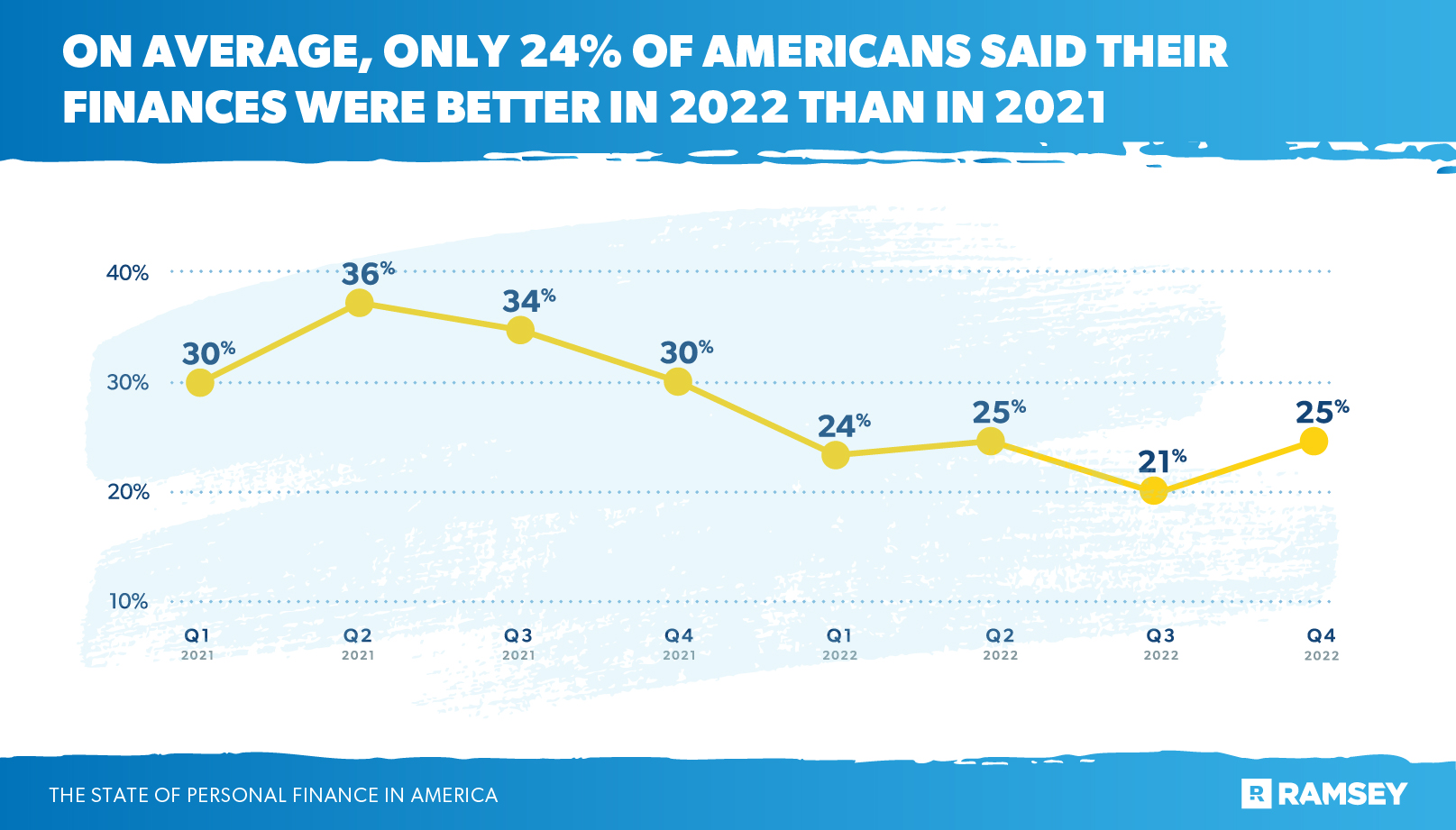

Only 24% of Americans said they had a better year financially in 2022 than they did in 2021.

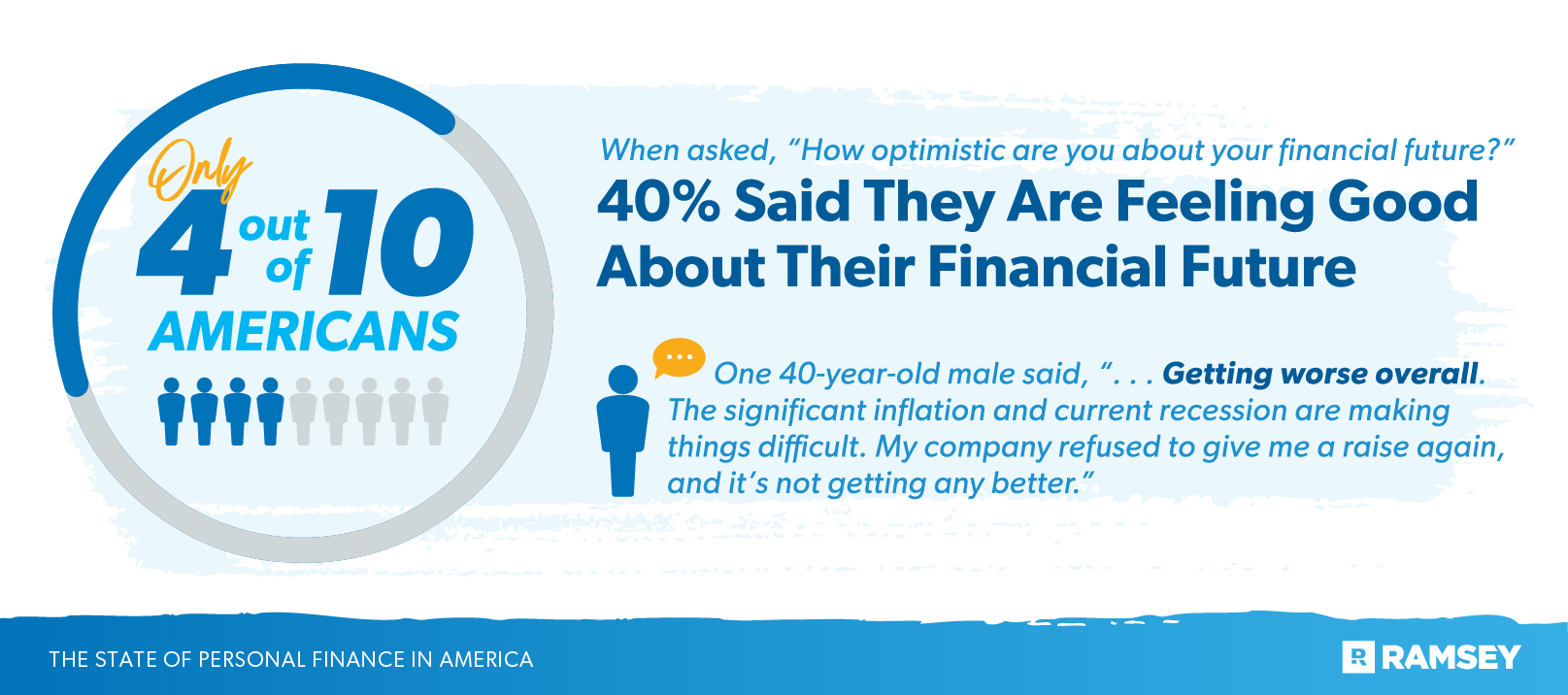

4 in 10 Americans are extremely or very optimistic about their financial future.

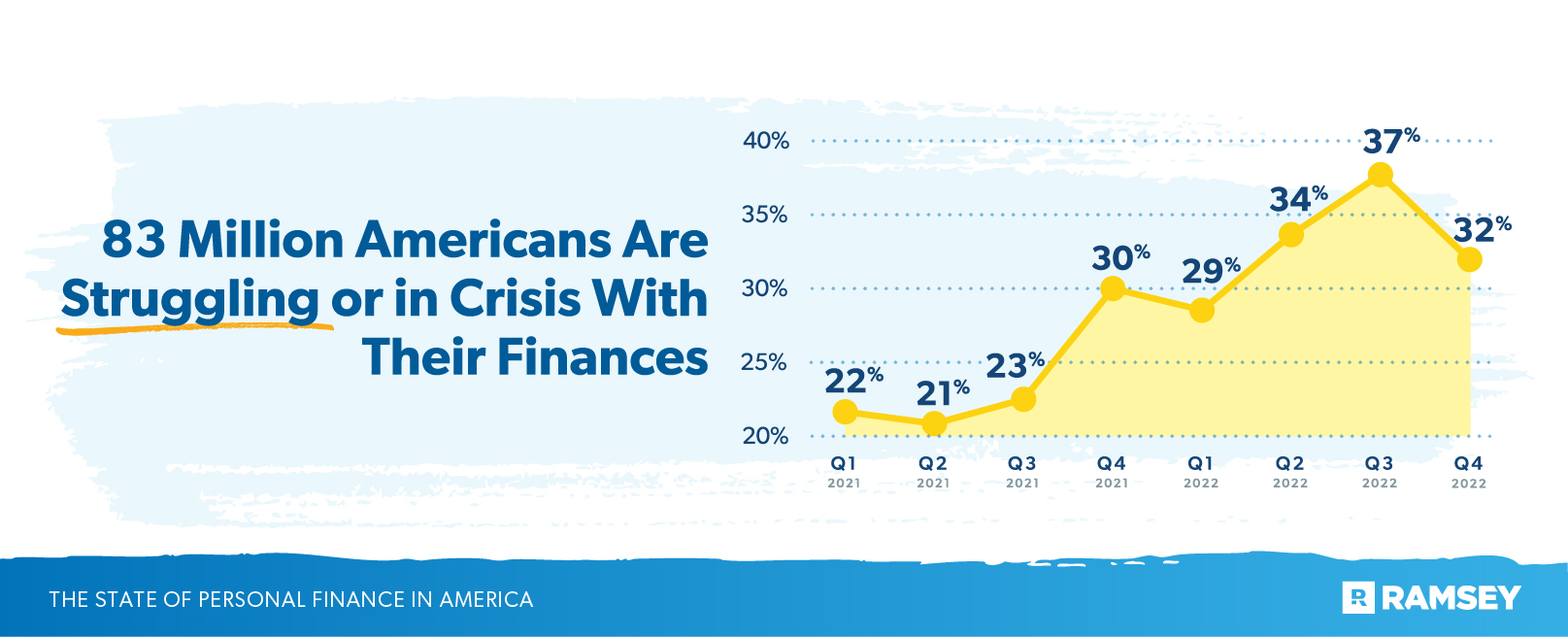

The number of Americans who said they’re struggling or in crisis with their finances increased by 45% over last two years.

Daily worry about finances is down from its peak in Q2 of 2022 (along with the number of people losing sleep over their financial stress), but it’s still up 23% from Q1 of 2021.

Download a PDF version of the report.

Economic Optimism Is in Short Supply

Americans have learned to deal with random shortages of everyday goods and necessities since the beginning of the COVID-19 pandemic. But now they’re dealing with a different kind of shortage—a shortage of optimism about the economy. In fact, 74% of Americans said that they were worried about the strength of the U.S. economy.

2022 Wasn’t a Great Financial Year for Most Americans

An average of only 24% of Americans said 2022 was a better year financially for them than the year before. That’s down 9 percentage points from 2021. Over the last two years, the number of people who felt better off peaked at 36% in the second quarter of 2021.

Men were more likely than women (28% and 22%, respectively) to say they made out better financially in 2022—but only slightly. Millennials were more likely than any other generation to say they had a better year (36%). And people who make an annual salary over $100,000 were twice as likely to say they had a better year compared to people who make under $50,000.

Small Number of Americans Are Very Optimistic About Their Financial Future

Since most Americans said 2022 was a bad year financially, it comes as no surprise that only 4 out of 10 Americans are extremely or very optimistic about their financial future. Millennials again took the top spot, with almost half (46%) expressing optimism.

The Financial Struggle Continues

The financial troubles of 2021 continued into 2022, with more Americans falling into crisis and turning to debt to make ends meet.

Americans Are Continuing to Feel the Pinch

When it came to their financial health, almost a third of Americans (32%) said they were either struggling or in crisis during the last quarter of 2022. While that was down from the high of Q3 of 2022 (37%), it’s still a 45% increase from the first quarter of 2021. Today, nearly 83 million Americans are dealing with significant financial strain.

Women were more likely to say they’re struggling with money than men (40% vs. 24%). Gen Z struggled with money the most at 40%, with Gen X coming in second at 35%.

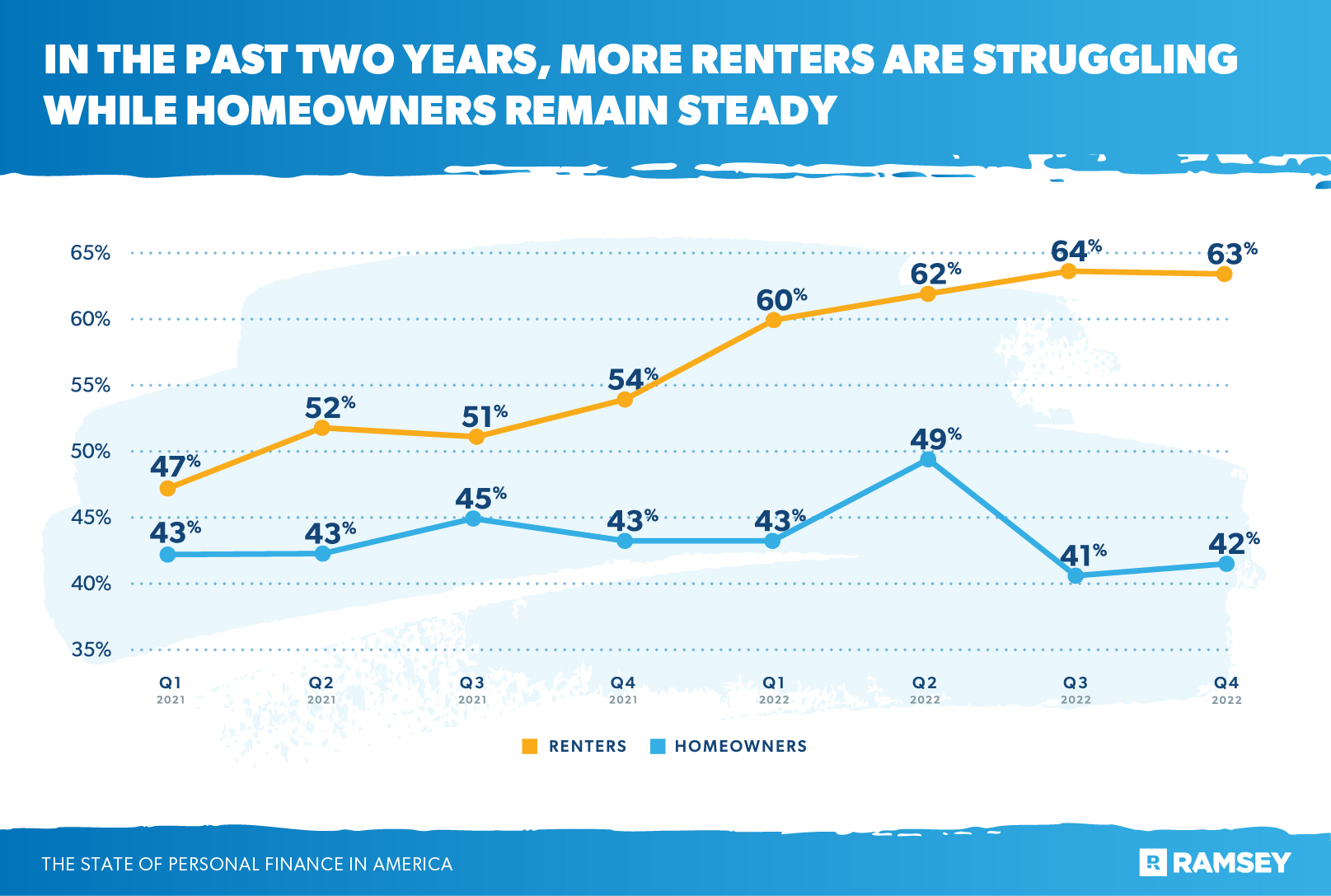

Trouble With Paying the Bills Increased

In the final quarter of 2022, just over half of Americans reported having difficulty paying their bills in the previous three months—a 42% increase over the last two years.

The number of renters struggling to pay their rent also saw a significant upward trend over the last two years. Six in 10 renters (63%) said they had trouble making rent in the previous three months in Q4 of 2022. That’s up 34% from the beginning of 2021. On the other hand, the number of homeowners having trouble with their mortgage has remained relatively steady since the beginning of 2021. But 4 in 10 homeowners still reported having difficulty making their mortgage payments.

Christmas Spending Decreased

As Americans dealt with the fallout of rising prices during 2022, many (47%) said they planned to spend less at Christmas in Q3 of 2022. And based on their answers in Q4, many followed through with that plan with 1 in 3 Americans saying they did, in fact, spend less on Christmas presents in 2022.

Living Paycheck to Paycheck Is a Way of Life for Many Americans

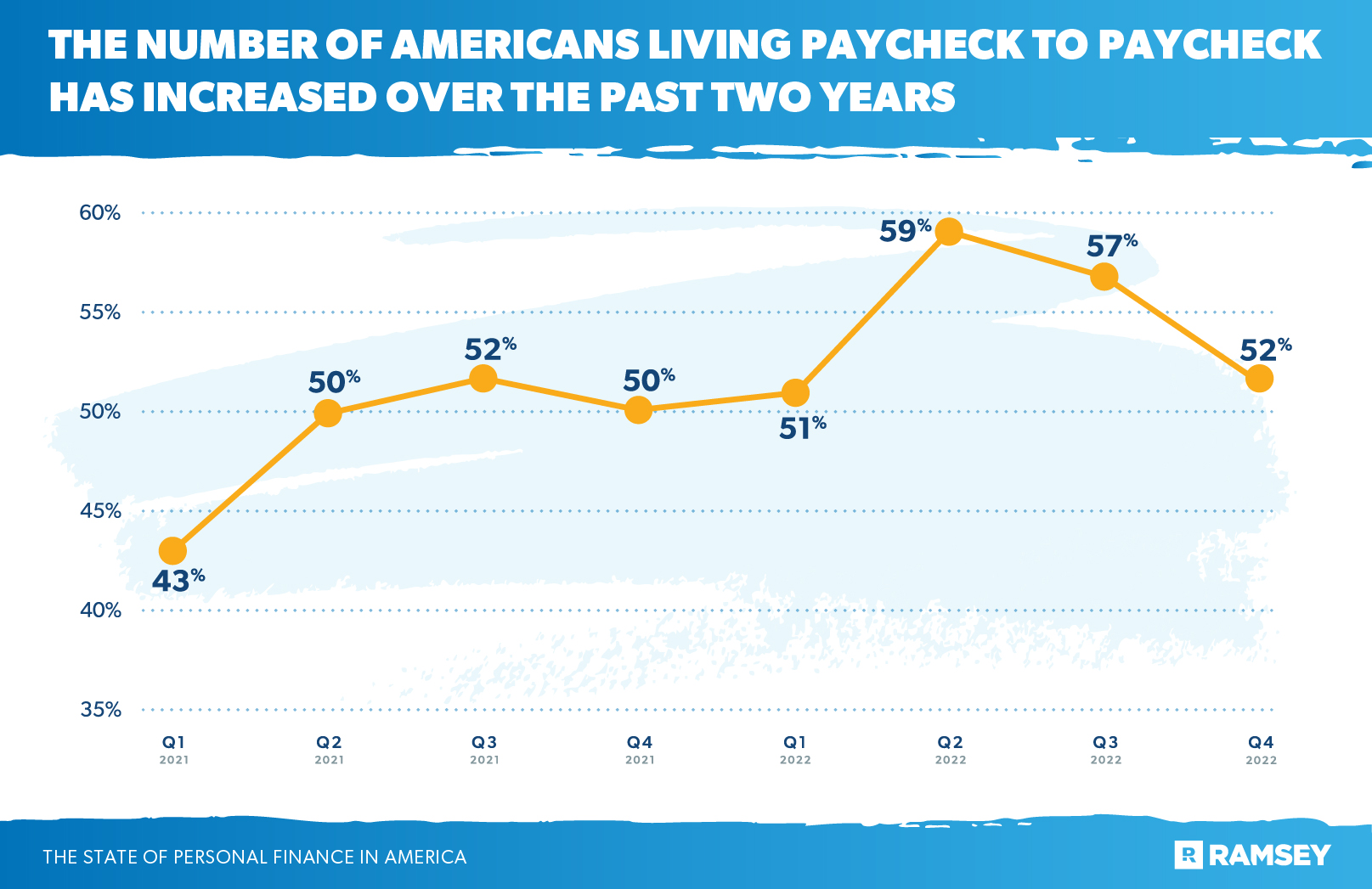

The economic uncertainty of the last few years has also highlighted the fact that many Americans live paycheck to paycheck. Just over half of Americans (52%) said they live paycheck to paycheck, up 23% from just two years before.

The majority of millennials live paycheck to paycheck (66%), and women are more likely than men to say they live paycheck to paycheck (57% and 46%, respectively). And not surprisingly, Americans who have consumer debt are far more likely to live paycheck to paycheck than those without debt (64% vs. 39%).

Even higher earners haven’t escaped the paycheck-to-paycheck cycle. Over a third of Americans making over $100,000 (34%) are living paycheck to paycheck.

Americans Have Little to No Savings

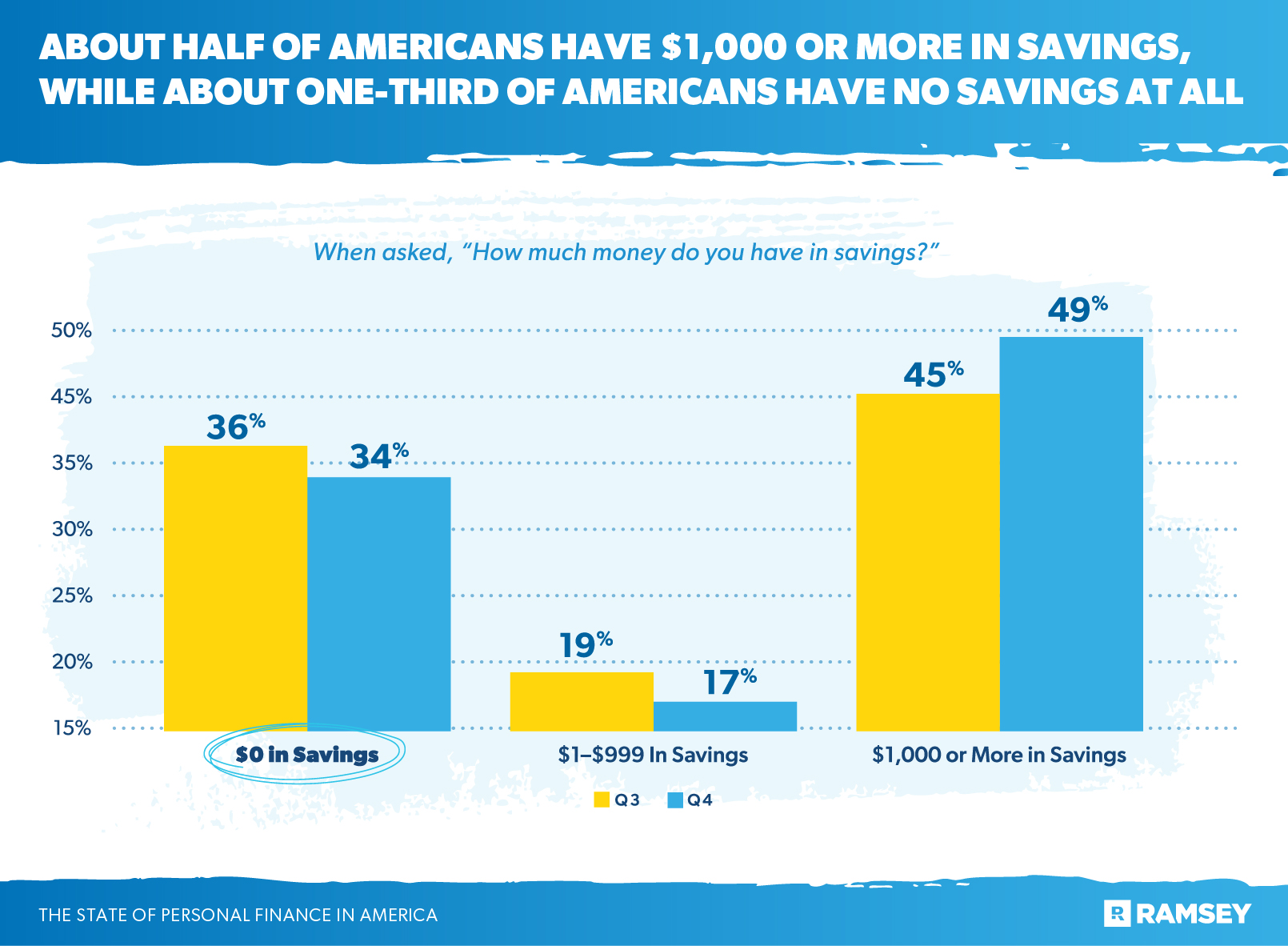

The paycheck-to-paycheck cycle is no doubt a contributing factor to Americans’ lack of savings. Only about half of Americans have $1,000 or more in savings (49%)—up from 45% in the previous quarter. One-third of Americans (34%) have no savings at all. That’s down slightly from last quarter (36%).

Americans Are Taking on More Debt

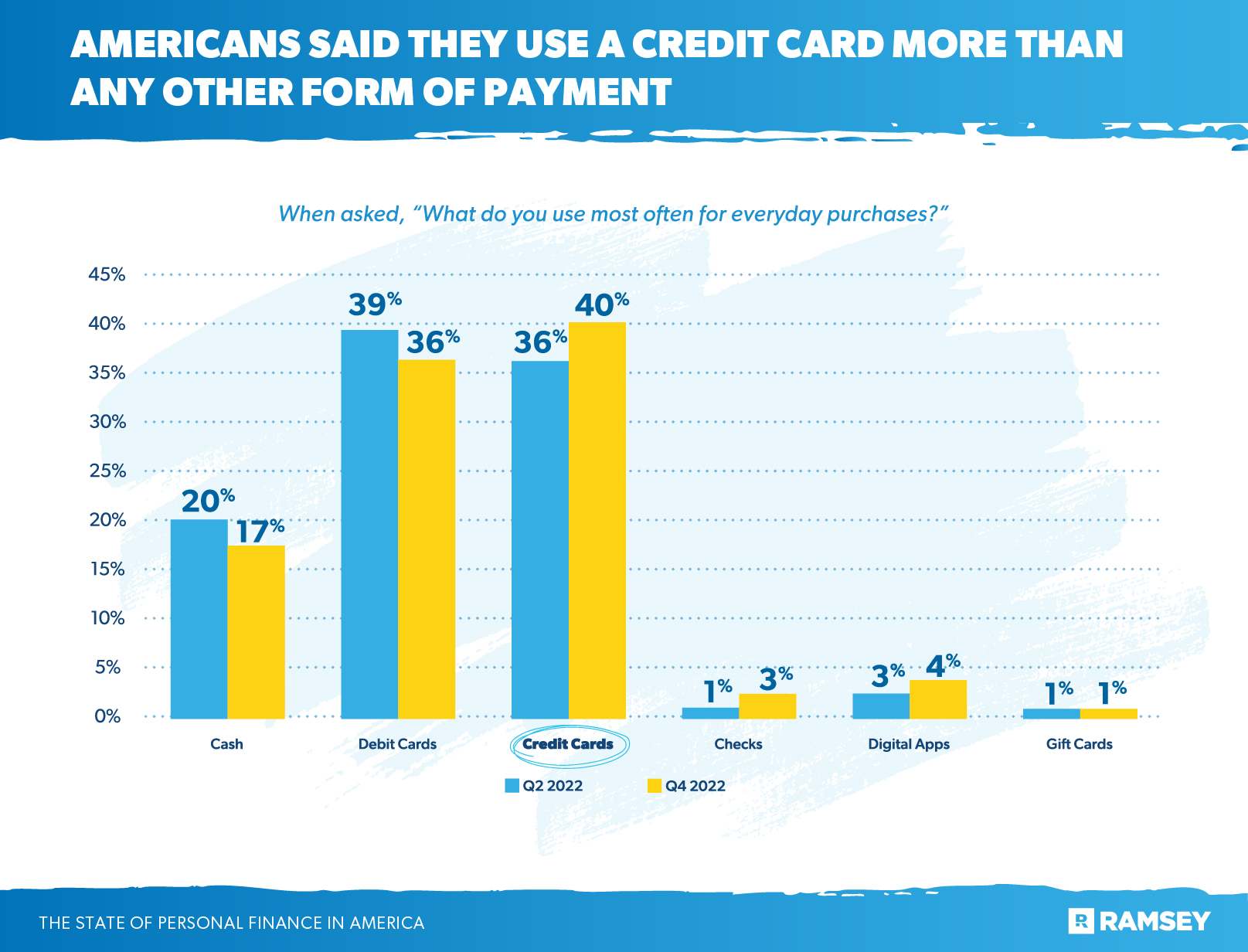

Because it’s been so difficult for people in the U.S. to make ends meet, many are turning more and more to consumer debt to fill in the gaps in their budgets. Credit card usage is on the rise, with 40% saying they use a credit card more than any other form of payment. About a quarter of Americans (24%) said they’re relying on credit cards more than normal. And the number of Americans who don’t have any credit cards has gone down 5 percentage points compared to the previous quarter (16% vs. 21%).

Baby boomers are the most likely generation to use credit cards (56%). Younger generations are less likely to use credit cards, with only 21% of Gen Z reporting they use credit cards frequently.

Financial Stress Continues to Impact Mental Health

The stresses of an uncertain financial future can have a debilitating effect on a person’s mental health. Depending on the severity of their situation, people often feel helpless, isolated and frustrated by money issues. A little more than half of Americans (54%) feel like they’re barely treading water and that they can’t get ahead with their finances.

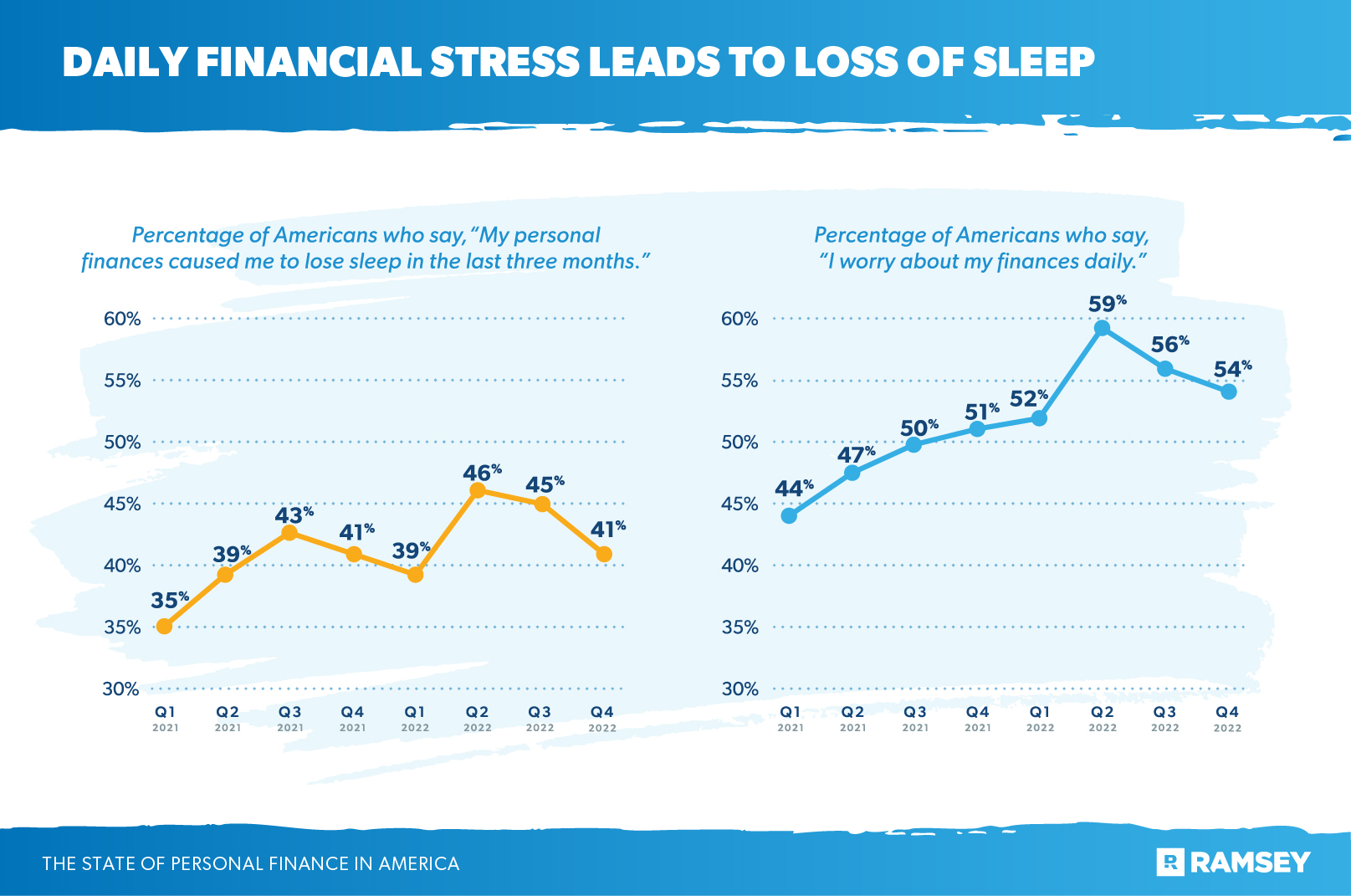

The same number of Americans in Q4 of 2022 (54%) worried daily about their financial situation. While that number is down from its peak of 59% in Q2 of 2022, it’s still 23% higher than the beginning of 2021.

Financial stress can also lead to a lack of sleep, and 41% of Americans said they lost sleep in the previous three months due to money troubles. And again, even though that number is down from the peak in Q2 of 2022 (46%), it’s still 17% higher when compared to Q1 of 2021.

Conclusion

Americans are realizing something’s wrong with the country’s economic outlook. Money problems are taking up more and more space in people’s minds. Many people are struggling more now to make ends meet than they did just a year ago.

However, a few of the statistical headlines in our report may point to a slightly more positive outlook for 2023. Certain trends—like the number of Americans who worry about money daily and the number of people struggling with money—peaked in mid-2022 and began a downward trend by the end of the year. (Though, they’re still significantly higher than they were at the beginning of 2021.)

One possible reason for the downward trend is that many Americans may have learned to adjust their spending and budgets to cope with the reality of rising prices caused by inflation—though, that doesn’t fully eliminate their financial worry.

Looking at the trend lines over the last two years, we see two possible scenarios that could be in store for 2023:

- The trajectory of these financial statistics could continue its downward trend. Prices for everything from food to gas to housing are still higher than normal, but they’re not climbing as fast as they did in 2021 and 2022. Americans could achieve better financial footing if they keep adjusting their spending as price increases continue to level off.

- The current downward trajectory in many of these trends could just be a momentary dip in an overall upward trend. That’s especially if the planned Federal Reserve interest rate increases lead to a recession and job cuts or if the war in Ukraine escalates, again threatening the supply chain and impacting gas prices.

Either of these outcomes would no doubt raise the levels of stress and worry many Americans have over money, as well as raise the number of Americans resorting to debt to make ends meet.

Americans Can Take Control of Their Money

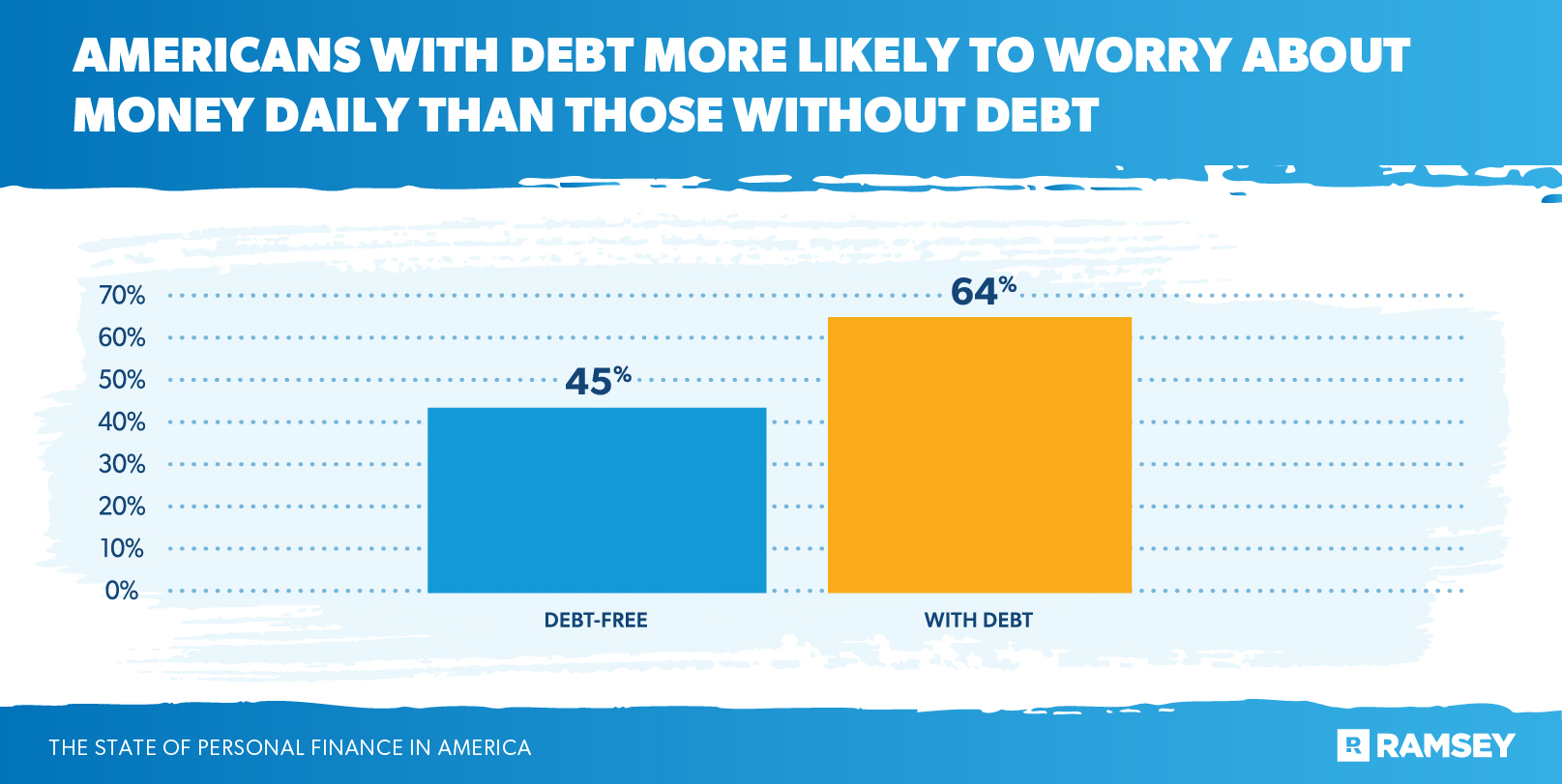

As we look back over the numbers from the last two years, we can’t ignore one consistent message that’s illustrated in the often stark difference between the outlook of those with consumer debt and those with no consumer debt. At times, the percentage difference is as much as 20 points, with those who are debt-free responding with a much more hopeful outlook, especially when it comes to money stress.

Here are just a few examples of the differences found within the data points covered earlier in the report:

- 64% of those with debt worry daily about money compared to just 45% of those without debt.

- 39% of those with debt said they’re struggling or in crisis when it comes to their finances compared to only 25% of those without debt.

- Over half of those with debt (62%) reported that they have difficulty paying bills compared to over a third (40%) of those without debt.

- 64% of those with debt said they’re living paycheck to paycheck compared to 39% of those without debt.

These statistics clearly show that a debt-free lifestyle can have a significant impact on a person’s financial situation—a concept that has been at the core of what Ramsey Solutions has been teaching for over 30 years.

About the Study

The State of Personal Finance study is a quarterly research study conducted by Ramsey Solutions to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded using a third-party research panel. Since January 2021, The State of Personal Finance has seen 8,081 U.S. adults participate in the study.

![How to Avoid Overdraft Fees [8 Ways] How to Avoid Overdraft Fees [8 Ways]](https://i0.wp.com/qualifylearner.com/wp-content/uploads/2025/05/How-to-Avoid-Overdraft-Fees-8-Ways-150x150.jpg)