Our take: Wesley Financial Group stands out with an impressive track record of cancellations and a responsive customer service team. It’s a family-owned business, and founder Chuck McDowell’s background in the timeshare industry is a frequent selling point, especially in marketing. But the company isn’t BBB-accredited, and complaints are higher than average.

It might be worth a look if you have time to compare options, but it doesn’t make our list of the best timeshare exit companies.

Timeshare Exit

- 50,000 timeshare cancellations

- Founded by a former timeshare insider

- Free initial consultation

- Responsive customer service team

- Not BBB-accredited

- Higher-than-average customer complaints

- Limited information about pricing

- Must complete intake call for plan details

| Initial consultation | Free consultation |

| Fees | One-time upfront fee |

| Process | Consultation, eligibility, plan, and execution |

| BBB rating | 4.43/5, Not accredited |

Wesley Financial Group boasts an impressive track record, having successfully canceled 50,000 timeshares and achieved a total savings of $635 million for its customers. The company specializes in canceling timeshare contracts, rather than selling timeshares. But you can’t get much information about the process until you complete a consultation.

Wesley Financial Group also isn’t BBB-accredited, and the customer complaints are higher than expected. Here’s an in-depth look at the company, including what you can expect as a potential customer.

Table of Contents

About Wesley Financial Group

Chuck McDowell founded the company in 2011 after working in timeshare sales and becoming disillusioned with the aggressive sales tactics. He created the company to help consumers get out of contracts. It’s a unique origin story that positions Wesley Financial Group LLC as a company with real-world experience.

How it works

Wesley Financial Group’s goal is to cancel timeshare contracts and release families from the mortgages and fees. It’s challenging to find detailed information about the exact process.

Here’s an in-depth look at the services Wesley Financial Group offers.

Free timeshare exit info kit

You can request a free timeshare exit kit from Wesley Financial Group. This digital package includes information about timeshare cancellation, money-saving travel tips, and the company’s background.

It’s a helpful way to learn more about Wesley Financial Group without going through an entire consultation. Most of the information is available online without signing up, but you can request a hard copy sent to your home for free.

100% money-back guarantee

The company offers a 100% money-back guarantee if the cancellation isn’t successful. It’s part of the industry standard to have a money-back guarantee or escrow account for payment. Both options help protect consumers from fraud. According to BBB and Reddit reviews, customers report that the company honors the guarantee.

Free qualification call

You can request a free qualification call by filling out the form online or calling 800-425-4081. Representatives are available every day of the week, and it’s easy to set up the intake. The call is straightforward, but you need to have information about your timeshare and finances.

Wesley Financial Group is a privately traded company located in Tennessee. The company focuses on the local community with different charity partnerships, including Tennessee Alliance for Kids, Metro Police Christmas Charities Toy Drive, ShowerUp, Paws and Warriors, and People Loving Nashville.

Wesley Financial Group timeshare cancellation cost

Like most other timeshare companies, Wesley Financial Group doesn’t provide information about pricing or plan details until you complete a free consultation. It’s pretty standard in the timeshare exit industry, but it makes it challenging to compare options. According to Wesley Financial Group customers on BBB, pricing ranges from $6,000 to $8,625.

$635 million saved

Wesley Financial Group has helped customers get rid of $635 million in timeshare debt, including mortgages and fees. The company encourages you to consider the long-term savings potential when paying the upfront fees. That mindset might work for some people, but others might not be able to afford the cost.

Is Wesley Financial Group legit?

Wesley Financial Group is a legitimate company. It’s always smart to watch out for timeshare exit scams as you search for the right company, though.

Here’s an in-depth look at Wesley Financial Group, including BBB complaints, AARP advertising, and lawsuits.

BBB complaints

Wesley Financial Group has a higher-than-average number of complaints on the Better Business Bureau and isn’t accredited. It seems like the company is aware of the issues and is trying to fix them.

A note at the top of the company’s BBB profile states, “Wesley Financial Group would like the opportunity to speak with the consumer before a complaint is filed at 615-465-0405. However, this is not a requirement before filing a complaint.”

Wesley Financial Group is also active on the site, replying to comments and trying to resolve each one. It’s an indicator that the company takes complaints seriously. Multiple customers have left additional comments stating that the complaint has been resolved.

Federal judge rulings

Wesley Financial Group has dealt with a handful of lawsuits over the years, often involving issues with vacation ownership developers or vacation rental companies, including Capital Vacations and Westgate.

One of the developers accused Wesley Financial Group of unethical business practices and a misleading money-back guarantee. Wesley Financial Group has also filed a lawsuit in response.

From a consumer perspective, the Wesley Financial Group lawsuits are less about the ethics of Wesley Financial Group and more about how the timeshare company might be damaging the potential profits of other companies.

Use of strategic default

Some lawsuits and consumer complaints claim that Wesley Financial Group advises clients to stop making timeshare payments, a strategy known as strategic default. For instance, Capital Vacations’ 2024 federal lawsuit alleges that Wesley instructs customers to cease payments, leading to foreclosure risks and credit damage.

Strategic default means intentionally stopping payments on a loan or contract to force a resolution or cancellation. It’s risky because missed payments can trigger foreclosure, collections, or long-term credit damage that’s difficult to repair.

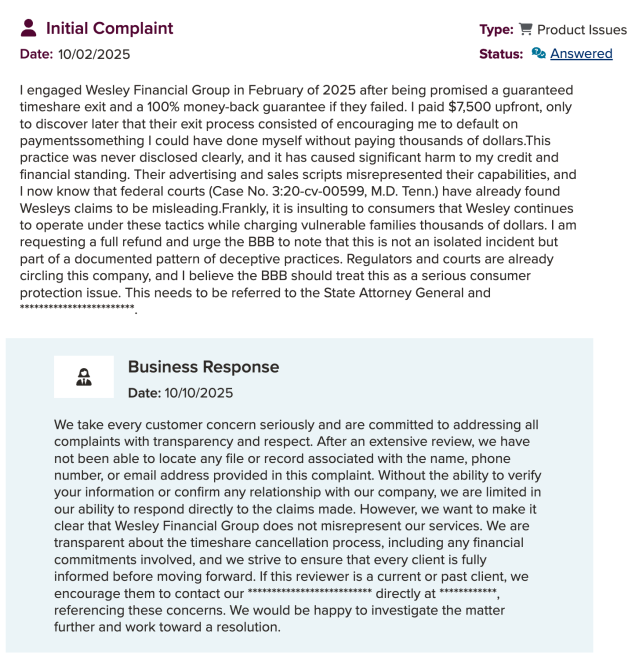

Similarly, a 2025 BBB complaint describes a customer experience consistent with this approach. We noticed that Wesley’s response did not explicitly deny it, instead emphasizing transparency and client consent:

While Wesley maintains that it acts ethically and informs clients about financial commitments, these reports have raised questions about its methods.

Heads up: Stonegate Firm, our team’s top-rated timeshare exit company, does not rely on strategic default and instead works through licensed legal channels to achieve cancellations without jeopardizing clients’ credit.

AARP ends advertisements

Consumers’ Checkbook reported in 2020 that AARP decided to enact a Wesley Financial Group suspension and no longer accept advertising from it due to lawsuits and BBB complaints.

But according to screenshots from print magazines and subscriber comments, AARP issues still include advertising from the company.

Pros and cons

Wesley Financial Group might be worth a look for some timeshare exit owners who want to end their contract. But it’s not the right option for everyone. Here’s what to consider as you decide.

-

Successful cancellation of over 50,000 timeshare contracts -

Company was founded by a former timeshare sales employee who had an inside look at the industry -

Get answers and additional information during a free initial consultation -

Customer service team is responsive and almost always available

-

Not BBB-accredited -

Higher-than-average number of customer complaints -

Hard to find information from the company about pricing -

Claims that the firm relies on strategic default -

Must complete an intake call for plan details

Customer reviews

Customer reviews can give you a better understanding of what it’s like working with a company. Wesley Financial Group’s reviews are quite positive, and most customers are happy with their experience.

Here’s an overview of Wesley Financial Group reviews from some of the biggest sites.

One Redditor shared that after spending around $15,000 on a timeshare they rarely used, they turned to Wesley Financial Group for help. After several months, the company confirmed their cancellation was complete, described as a “huge win” and a financial relief for their family:

Here’s the bottom line.

- What it does well: Thousands of reviewers report a positive experience working with Wesley Financial Group. Customers say that the company is effective at canceling contracts, and representatives go above and beyond to help.

- Where to be cautious: Some customers report that the fees are high, and that they could have saved money by doing it themselves or working with a different company. A handful of Wesley Financial Group’s bad reviews come from people who have never worked with the company but report receiving excessive spam calls.

Alternatives

Here’s a look at some of our top picks for timeshare exit companies, and how they compare to Wesley Financial Group.

Initial consultation

Free consultation

Fees

One-time upfront fee

Process

Consultation, eligibility, plan, and execution

Best Overall

Initial consultation

Free virtual case review

Process

Eligibility check, legal review, strategy session, and execution

Best Customer Support

Initial consultation

Free 30-minute consultation

Process

Pressure campaigns, title transfer, or attorney representation

Best for Timeshare Resale

Initial consultation

Free consultation

Fees

Payment due after sale or transfer

Process

Guaranteed transfer plan, brokerage services, or sales

Wesley Financial Group vs. Stonegate Firm

Stonegate Firm is our top pick for timeshare cancellation. The company stands out by being upfront about the entire process and what to expect, and Stonegate never recommends strategic default.

It also positions itself as a last resort and encourages customers to contact the developer directly first. But our favorite feature is Stonegate Firm’s co-branded law firm offering limited-scope legal representation.

Wesley Financial Group vs. Centerstone Group

Like Wesley Financial Group, Centerstone Group focuses on timeshare cancellation. Centerstone Group has Spanish-speaking agents, three specific strategies, and helpful customer service. The company also holds payments in an escrow account for additional accountability.

Wesley Financial Group vs. Timeshare Specialists

The Timeshare Specialists help with reselling timeshares and transferring ownership. It’s a different approach that might be a better option for some owners. You don’t need to make any upfront payments, and the company guarantees the sale.

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- Checkbook, Trouble With Timeshare Exit Companies

- Better Business Bureau, Wesley Financial Group

- Wesley Financial Group, How Much Does it Cost to Cancel a Timeshare?

- CBS42, Wesley Financial Group Helps 10,000 Families Cancel Timeshare Debt in the Last Year

- Reuters, Vacation Timeshare Developer Westgate Defeats ‘Exit’ Company’s Lawsuit

- Justia U.S. Law, Capital Resorts Group LLC v. Wesley Financial Group LLC et al, No. 4:2024cv03043

- Wesley Financial Group, Get Your Free Timeshare Exit Info Kit

- The Silicon Review, Chuck McDowell, Founder and CEO of Wesley Financial Group, LLC, Speaks to The Silicon Review

- Wesley Financial Group, Wesley Financial Group Year in Review 2024

- Consumers’ Checkbook, Trouble With Timeshare Exit Companies

- AARP Online Community, Cancel Timeshare Ad

- Timeshare Users Group, New Timeshare Exit Ad

- Trustpilot, Wesley Financial Group

About our contributors

-

Taylor Milam-Samuel is a personal finance writer and credentialed educator who is passionate about helping people take control of their finances and create a life they love. When she’s not researching financial terms and conditions, she can be found in the classroom teaching.

-

Kristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.